Stock Option Trading Strategy – Bullish put spreads.

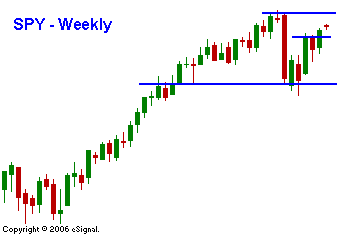

It feels like everyone decided to extend the holiday. Trading has been light and the ranges are tight. All eyes are now fixed on earnings season and it kicks off after the close today with AA. The range is set and a breakout above SPY 146 or a breakdown below SPY 141 will set the tone for the next few months. If the range is intact by mid-May, trading will get very quiet this summer. My stock option trading strategy remains to sell bullish put spreads on stocks I like. I have closed my bearish call spreads and I feel that we are too close to making multi-year highs for comfort. I am market neutral and I’m looking for stocks that held up well during the February decline. If the market does drop, these stocks should give me time to close my put credit spreads. The A/D is a positive 2:1 and I’m looking for a quiet grind higher – nothing big.

Daily Bulletin Continues...