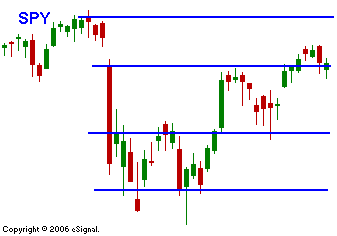

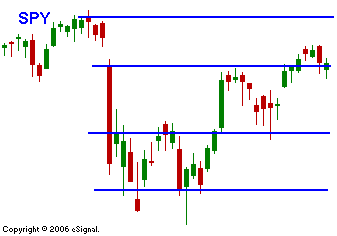

Stock Option Trading Strategy – Bullish put spreads with SPY above 141

The market is burning time while it waits for earnings releases and the PPI tomorrow. Yesterday the Fed minutes were released and the market reacted to comments about rising inflation and the possibility of moderating economic activity. This should not have come as a surprise since this is consistent with the initial FOMC comments that were released two weeks ago. In the absence of news, the bears took some of the fluff out of the market and higher oil prices gave them a little help. I viewed the action as a lack of buying rather than an abundance of sellers. Today, robust retail sales have propelled stocks higher after the downside was tested early. The A/D is a positive 3:2 and it looks like the market might grind higher and erase some of yesterday’s loss. From a technical perspective the bulls want to see the second blue line in the chart hold. It represents the open from the February 27th decline. This is a time to tread carefully. The market direction for the next few months will depend on earnings. In the next few weeks, we will know the extent of the slowdown in the earnings growth rate. The Fed has made it clear that they are satisfied with the current interest rate level and that market “catalyst” will be absent. The path of least resistance is up. My stock option trading strategy still favors bullish put spreads. If the SPY breaches 143, I will close some of them. If the SPY breaches 141 I will close them all. If the SPY rallies, I will look to add new bullish put spreads. At best, my market bias is neutral.

Daily Bulletin Continues...