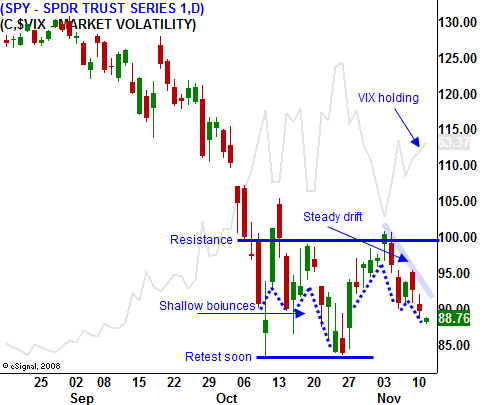

Slow Steady Decline Is Very Bearish – SPY 85 Will Fail!

The market continues to drift lower in an orderly manner. This is not a good sign for bulls as the market approaches previous support at SPY 85. Ideally, buyers would like to see aggressive bidding as the market approaches this level. Unfortunately, that's not going to happen.

There is no reason for Asset Managers or investors to engage the market at this level. This is not a temporary pullback that will quickly reverse so no one is worried that they will miss a buying opportunity. Bearish conditions will last for years and the bad news keeps on coming.

Circuit City is going out of business and Best Buy described this environment as the worst ever. Express carrier DHL is halting US operations. Their industry is a barometer for economic activity.

During the final Presidential Debate, “Joe the plumber” was referred to many times and it reminds me of a joke. A dentist asks his plumber for the bill and is shocked to learn that it is $400. He says, "$400? You were only here for an hour. I'm a dentist and I don't even make $400 an hour." The plumber replies, "Neither did I when I was a dentist." As Americans we expect to be paid top dollar and there are people around the world who are willing to do the work for a fraction of our pay.

The "Big 3" are on the ropes and Ford and General Motors are collectively burning through $5 billion of cash a month. The unions have negotiated sweet deals and US car manufacturers can't compete. They were living on borrowed time and the decision to produce gas guzzling vehicles will do them in. If the government plans to save the 2 million jobs tied to this industry, they need to renegotiate the labor contracts or walk away. Without question, new management is needed.

As a nation, we are broke and that reality spreads from the government, to the states, to municipalities, to individuals. What does a $25 billion bridge loan do for an auto industry that is burning through $5B a month? If General Motors produced electric cars, no one could afford them and sales would still be dire. Car lots are filled with inventory and used cars are selling for $.20 on the dollar. This glut of cars resulted from overproduction and the UAW negotiated a contract where they would receive 90% of their pay if they were laid off. Car manufacturers decided that it was better for them to keep producing since their labor costs were going to be incurred anyway. This oversupply will last for years as conditions deteriorate.

Companies have moved manufacturing overseas because the labor is much cheaper. They also aren't straddled with health care costs, OSHA, EPA, Sarbanes-Oxley and the second-highest tax rate in the world. President-Elect Obama wants to raise corporate taxes. Successful companies will leave and the failures will seek shelter under the TARP. A local example is Abbott. They are moving their diagnostics division to Ireland for tax reasons.

Our high school graduates rank 25th in the world. There are smarter people around the globe willing to work harder for a fraction of what we expect to get paid.

Americans should prepare work harder and longer for much less. We need to pay down our debt and stop looking for government handouts.

The only pleasure I get from all of this is making money on my short positions. Stay short!! The market is in a steady drift lower and that is VERY bearish. The moves are sustainable and bears are not getting ahead of themselves. Heading into the support level, we are not even registering a blip. Hedge funds redemptions will be served until Nov 14th and the selling will continue. I expect SPY 85 to fail this week.

Daily Bulletin Continues...