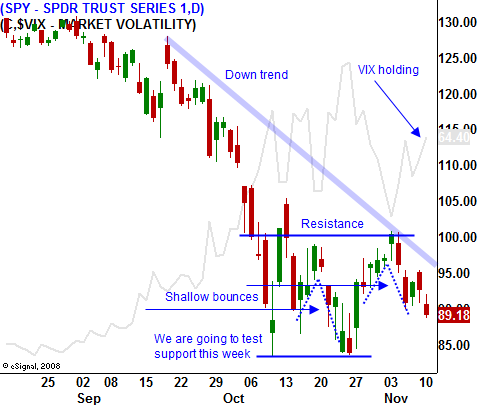

Short With Confidence – SPY 85 Support Could Fail!

Bad news lurks around every corner and the market is likely to retest major support at SPY 85 this week. Yesterday, financial stocks weighed on the market as new write-downs from Fannie Mae resulted in a $29 billion loss last quarter. The Fed will have to infuse billions to make good on its promise to keep shareholder equity in the black.

The big three automakers are burning through cash at an alarming rate. President-elect Obama urged President Bush to approve additional funding for General Motors, Ford and Chrysler. It is estimated that over 2 million jobs would be lost if these companies fail. Unfortunately, their business models are flawed and a bailout would only prolong the inevitable. Their production costs are sky-high relative to rival automakers. They are at a competitive disadvantage and they can't ever stumble because they have no margin for error. Analysts keep pointing to the Chrysler bailout and how well that worked out. That was only one manufacturer, not an entire industry. It was also a $1.5 billion loan. GM alone would burn through that cash in a few weeks.

Apparently, the solution is to tax the crap out of well-run companies so that we can support the ones that deserve to fail. The problem with this model is that corporations can pull up their tent stakes and move to a country that has favorable tax rates. Abbott is doing just that with their diagnostics division. They are very profitable and they are moving the division to Ireland for one reason – taxes.

Foreign markets were excited to learn of China's stimulus package. They now have their own $600 billion bailout. I'm not as excited about the news. While this amount is comparable to what we are spending in the United States, it represents a much larger 18% of their GDP. In order to finance this bailout, they will have to sell some of their US Treasuries. This will put downward pressure on US Treasuries at a time when our government is trying to raise capital of its own. It also means that China will barely participate in future bond auctions.

Standard & Poor's warned that US debt ratings are dangerously close to losing their AAA status. If our debt is downgraded, that will further destroy investor confidence and it will dramatically increase our cost of capital. Six months ago, it was projected that in the year 2020, 100% of our national budget would go to paying interest on our national debt and to entitlement programs (Social Security, Medicare, unemployment). The bailouts will greatly add to our national debt and by the end of the year it is projected to be around $10 trillion. If our cost of capital rises quickly on a downgrade, that timeline could easily be moved up by five years given the huge expenditures. Imagine that in 5 years 100% of our nation budget will be chewed up in interest payments and entitlement!

We have spent our way out of every recession and we have no choice but to try it again. Every country in the world is dealing with its own problem and the appetite for US debt is drying up.

After 9/11, Greenspan lowered interest rates to stimulate our economy. People refinanced their mortgages and they spent the cash. Even though Fed Funds Rates have fallen to those levels, lower interest rates are not filtering through to consumers. Banks have kept interest rates high because of credit risk. Friday, J.P. Morgan announced that credit card default rates have risen to 5%. That is a 40% increase year-over-year.

Americans are tapped out. Their portfolios have dropped by 50% in the last year and their home values are down by 25%. During the last two years, we have seen a negative savings rate and people are spending more than they make. This trend has been going on for over a decade, but at least the savings rate was positive in 2006. A few months ago, 60% of baby boomers had less than $100,000 saved for retirement. With the recent market decline, I'm sure that percentage has gone up to 75%. This means that people will not be able to retire early.

A larger workforce competing for fewer jobs translates into lower wages. We can expect to work harder, make less and retire later. If we learn from our mistakes and we save money, we can work our way out of this mess in 5 to 10 years.

In addition to making money by shorting the market, I suggest you tighten your belt. What we are seeing now is only the beginning. To truly appreciate the recent decline, bring up a 10 year chart and look at how dramatic the decline has been. There are bona fide reasons for this crash and unlike the ones we've experienced in the last 30 years, this one is not going to rebound quickly.

As I've been stating, the market is likely to retest support at SPY 85. I believe that level will fail this week. We have a lame duck President and a need for immediate action. Investor confidence is already shaken and the bad news keeps coming. People have no reason to stick their neck out and bottom fish a market that is in a free fall.

I am selling OTM call credit spreads (bearish call spreads) to finance the purchase of OTM put debit spreads (bearish put spreads). This strategy allows me to sell expensive premium and offset the expensive premium I am buying. I am selling November calls to take advantage of time decay and buying December puts. REITS and retail are my favorite two sectors to short.

Daily Bulletin Continues...