Support Held For Now – Long-term Bearish Price Action!

This just in, more bad news. Investors expect to get slapped in the face every time they turn on their screens. Staying short has been good for my psyche and it helps me cope with dire conditions.

Initial jobless claims rose to 516,000 last week, the highest level since 9/11. Continuing jobless claims are near 4 million and Americans can't find work.

Last week, J.P. Morgan announced that credit card defaults rose 40% year-over-year to 5%. Last year they were at 3.4%. The concerns are legitimate and yesterday American Express took shelter under TARP. Today, bank regulators rejected a request by banks to let them forgive as much as 40% of credit card debt for consumers who don't qualify for existing repayment plans. Obviously they wanted to sweep this into the bailout. This crap is making me sick.

Let's just bail out everyone who lived way beyond their means and the idiots who kept lending them money. It was hard enough for me to believe that people were suckered into buying a house they couldn't afford. Now I suppose they were tricked into buying new cars, vacations and plasma TVs too.

Capitalism is supposed to punish poor decision-making, not reward it. If we start supporting inefficiency, the whole system will fail. The big three automakers are a classic example. Millions of jobs hinge on their survival. It will take them years to retool and produce fuel-efficient vehicles. In the meantime, I guess we are supposed to pay UAW workers while they twiddle their thumbs. There is an ocean of new and used cars that no one is buying. If the government bails out automakers, will they continue to produce cars?

I understand the difficulty in supporting a family and going back to school - I've done it. I left the restaurant business 20 years ago and I mortgaged everything to get my MBA. Diploma in hand I went to Chicago and took a position as a runner on the CBOT making $4.50 an hour. I commuted four and a half hours every day to get my foot in the door. The financial industry has been in continual flux and I had to stay one step ahead. In the late 90s, it meant leaving a huge book of business and starting fresh with another company because the business was going electronic. In 2002, it meant learning a new profession (trading) and supporting a family of five. Each of these changes has been difficult, but I'm in a better place now.

We can't keep support business models that don't work and lifestyles we can't afford.

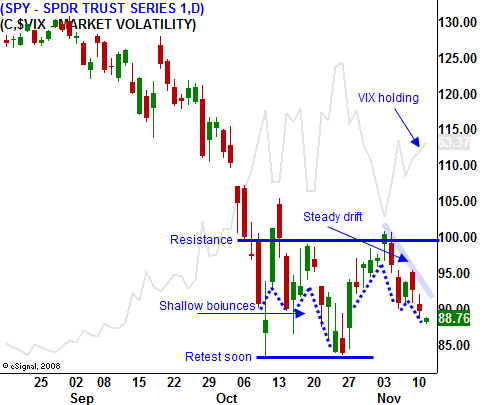

The market has broken below support and the threat of a sustained rally is minimal. Stay short.

Daily Bulletin Continues...