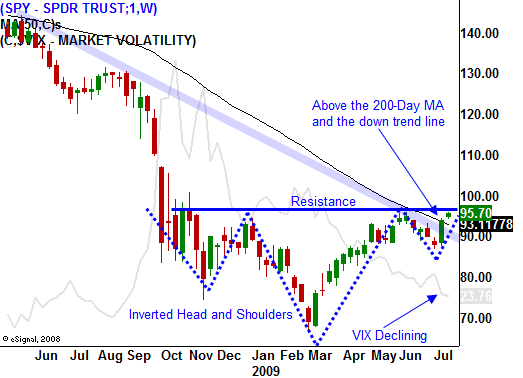

The Market Is Challenging The June Highs – A Breakout Could Spark Short Covering!

Yesterday, the market rallied on the open and it tested the downside most of the day. A late rally pushed it back into positive territory and bulls once again flexed their muscles.

Earnings have been decent and the majority of companies are beating estimates. Corporations have been quick to control costs and that is boosting profits. The concern is top line growth. The unemployment rate continues to climb and that will crimp consumption. Almost 70% of our GDP is dependent on consumer spending and without it, revenues will slump.

During the last 12 hours, there have been a flood of earnings releases. Apple continues to post great numbers and the stock is helping the tech sector. Financial stocks and cyclical stocks feel heavy and they are pulling back after releasing earnings.

There will be another huge round of earnings releases before tomorrow's open. Perhaps the most important release will come from UPS. Transportation stocks have been posting weak numbers and most are not seeing signs of a recovery. Union Pacific will also release earnings before the open. Most analysts feel that any sustained recovery will result in increased shipping activity. Regardless of the results, rail stocks have held their own.

During the last two weeks, initial jobless claims have been better than expected. While this is good news, I am skeptical of the improvement. Two weeks ago, the Fourth of July holiday could have had an influence. History tells us that people postpone filing for unemployment until they return from vacation. Last week, initial jobless claims were favorably adjusted to reflect seasonal patterns. That adjustment accounts for temporary summer layoffs in the auto industry. Many of those jobs have been permanently lost and the adjustment is painting bright picture.

The market has made a tremendous run during the last two weeks. Earnings have been good enough to justify the move. The upward momentum is strong and every time the market tries to decline, buyers step in. As long as interest rates don't creep higher, this market could challenge the relative high made in June. The key is to watch the bond auctions every other week and monitor yields.

After the last week, I am in a "buy the dip" mindset. The market is strong and earnings have been decent. The most explosive moves have come on the upside and that is where the greatest risk lies. As a result, I am looking for stocks that have released strong earnings and I am selling out of the money puts on those stocks. The market is searching for direction and the volume is light. Consequently, I am keeping my position size small.

For today, look for choppy price action with a slightly positive bias. Advancers outnumber decliners by 3 to 2. We are right up on major resistance and a close above SPY 96 would spark additional short covering. The fact that the market has been able to hold its gains tells me that bulls will try to make a run at a new high soon. If we make a new high after two o'clock Eastern time, we are likely to have a late day rally and a breakout above the June highs.

Try not to chase this market. The earnings news has been decent, but not excellent. We just had a bona fide breakdown that turned out to be a head fake. This breakout to the upside could sucker many people in and reverse. Keep your size small.

Daily Bulletin Continues...