Dead Till The Fed. Look For Opportunities To Sell Put Spreads – Be Patient!

Last week, the market staged a big rally based on "less bad" economic numbers. Once the momentum was established, quadruple witching buy programs fueled the rally.

This morning, leading economic indicators came in slightly below consensus estimates, but the number improved to a new 18-month high. Supplier deliveries, the interest rate spread, stock market prices, building permits and consumer sentiment were positive influences. Real money supply, average weekly initial claims and nondefense capital goods orders were a drag on the index.

Wednesday, the FOMC will disclose its interest-rate policy. They are likely to maintain their current 0% to .25% target rate for Fed Funds. I doubt that they will talk about their exit strategy for quantitative easing and the market should react positively. Regardless of the recent rally in the stock market, our economy is still in a fragile state and they do not want to prematurely tighten. Inflation is not a concern so they will not feel compelled to raise rates any time soon.

Initial jobless claims, existing home sales, durable goods orders, consumer sentiment and new home sales will be released Thursday and Friday. Durable goods orders will see a big spike due to cash for clunkers. Traders know that this is a temporary improvement and I doubt the market will rally off of the number. New and existing home sales could provide a spark this week. This is one of the deepest housing cycles we've ever witnessed and sooner or later conditions have to bottom out. Low interest rates, falling home prices and first time home buyer incentives should finally start to take root.

This week, there will be two year, five year and seven year note auctions. These shorter-term maturities have been in high demand and interest rate yields should remain low.

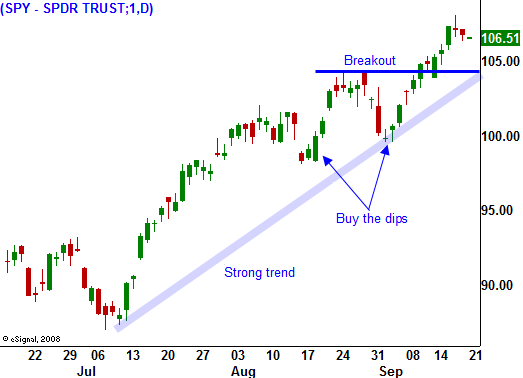

The momentum favors the upside in a light news week. As long as the market is able to hold the breakout above SPY105, stick with long positions. If we break below that level, take profits and wait for signs of support before reentering. This market still feels like it has upside.

I like selling put credit spreads on strong stocks with solid support so that I can distance myself from the action. This strategy has worked well and I have a clean slate to work with after option expiration. I will initiate some trades today, but I will look to add on pullbacks.

The market started off on a weak note today, but it has quickly recovered. Decliners outnumber advancers by 2:1 and we could see a little weakness today after a big run up. Trading activity will pick up Wednesday, but I expect quiet trading ahead of the Fed.

Daily Bulletin Continues...