The Magnitude Of This Bounce Will Be Very Telling – Watch The Price Action!

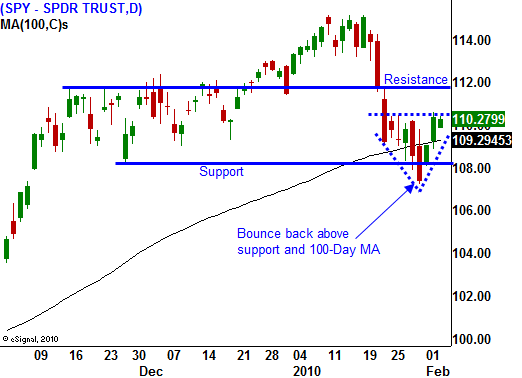

This week, the market has been able to rebound after a sharp decline the past two weeks. It has rallied back above horizontal support at SPY 108 and it has pushed back above the 100-day moving average.

Concerns over the credit situation in Europe sparked selling. Greece and a number of other smaller countries are running huge deficits and with extremely high unemployment levels, the default risk is high. The European Central Bank said that it will not bail countries out. If they start to fall one by one, a domino effect could rattle the entire EU. Conditions will have to worsen over many months for this to happen. However, the first warning sign emerged last week when Greek bonds instantly priced in a 50 basis point risk premium. It will be difficult for these countries to raise capital.

Political uncertainty also prompted investors to take profits. Democrats lost an important Senate seat in Massachusetts and the President's approval rating is dropping. Each week there seem to be new plans, programs and committees. Budget deficits continue to escalate and there is no end to the spending. Obama paid lip service to the problem by instituting a spending freeze for the next three years on a tiny portion of the overall budget. Dramatic reform for Social Security and Medicare need to be addressed. Instead, the focus is on a healthcare reform program that will break the bank.

Economic news has been good during the last week. GDP rose 5.7% and that was much better than expected. ISM manufacturing hit 58 on Monday and this morning, ISM services rose to 50.5. Both indicate economic expansion. The ADP employment index showed that 22,000 jobs were lost in January. That was better than analysts had expected.

Earnings have been decent, but cyclical stocks are selling off after the release. Their guidance for Q1 is very guarded and most feel that the economic recovery is tenuous. Stocks are priced for a full-blown recovery and there is room for disappointment.

Tomorrow's initial jobless claims number will be important. Job losses have increased three weeks in a row and each time the number has been a disappointment. If we get another bad number tomorrow, the market will sell off ahead of Friday's Unemployment Report. Analysts are forecasting job growth and they expect 13,000 jobs to be added in January. I'm not as optimistic and I feel that we will miss expectations. If the job losses are minimal, the market could still rally. If there are more than 50,000 job losses, the market will decline. Today, Challenger, Gray & Christmas reported that employers plan to lay off 72,000 workers. This is the first time this number has increased since July of last year and it shows that job growth will be even tougher to hit in coming months.

There are dark clouds on the horizon, but it could take months for the storm to blow in. The magnitude of this snapback rally will be very telling. If we hit early resistance and the market can't get back above SPY 112, we will know that fear is growing and prices will move lower in the near future. On the other hand, if the market can easily rally back above SPY 112, a decline might be months away.

I prefer to trade from the short side. I will sell put credit spreads in small size on strong stocks while I wait for the breakdown. I have started placing orders to buy puts on stocks when they break technical support. If the market rallies, I will wait patiently and I am likely to raise the price points where my put orders will be triggered. This is a good time to be patient and to observe the price action.

The market is transitioning and these inflection points are tough to trade. Bulls are still optimistic and they view these dips as a buying opportunity. Bears are getting anxious and they want to sell into the rallies. Until one side wins definitively, the price action will be very choppy and random. Once we get a major breakdown with sustained selling, it will be easier to stick with short positions.

For today, the market is giving back some of the gains during the last two days. The economic news has been decent and I am not expecting a big decline today. Line up your shorts and place your orders. You never know when the big drop might come.

Daily Bulletin Continues...