The Market Is Headed For Trouble – GET SHORT!

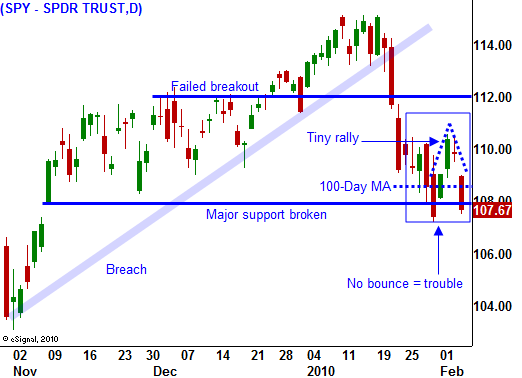

When the market can't rally on good news, it sends a strong warning to all investors. Last Friday, fourth-quarter GDP rose 5.7%. That was much better than analysts had expected and the market sold off into the weekend. More importantly, it broke key horizontal support at SPY 108.

Monday morning, worries subsided and end-of-month fund buying supported the market. ISM manufacturing came in better than expected and that also provided a boost. By Tuesday's close, the market had rebounded and it was back above critical support levels.

Yesterday, the ADP employment index was a little lighter than expected. ISM services came in at 50.5 indicating economic expansion in the service sector. Overall, the news was pretty good.

Last night, Portugal held a one-year bill auction and these short-term maturities are relatively liquid and risk free. There weren't enough buyers to support this tiny $1 billion auction and Portugal had to pull it. The demand for European debt is drying up at an alarming rate. There are many countries that are dangerously close to default. The problem spots include Portugal, Ireland, Italy, Greece, Spain, Bulgaria, Latvia and Lithuania.

Greece held a bond auction two weeks ago and the initial demand was high. They were able to generate a 2.6 bid to cover. However, days after the auction, bond yields spiked by more than 50 basis points. This indicates that risk premium is being priced in and the appetite for European debt is drying up. The market took notice and this was the first crack in the dam.

We've seen how difficult it was for the US to shore up its credit issues. Every politician had a different opinion of how to solve the problem and now the people who saved us from financial disaster are being grilled by Congress. Regardless, our nation has a centralized banking system and we were able to do what was necessary.

That is not the case in Europe. Even though they have the ECB, there is dissention among the ranks. Each EU member has its own financial structure and collectively they won't be able to agree on the proper course of action. It doesn't help that the ECB Pres. is completely inept. A year and a half ago, Jean Claude Trichet said that he did not see signs of a financial crisis. Financial institutions were crumbling and global markets were crashing. He kept European interest rates high in the face of collapse. Two weeks ago he again showed his ignorance. Greece was in financial trouble and he added to their woes by publicly stating that the ECB would not bail them out. The EU is dangerously close to experiencing a domino effect. If immediate action is not taken this evening, we will see a massive selloff into the weekend.

As for our situation in the US, initial jobless claims dropped more than expected for a fourth consecutive week. This does not bode well for tomorrow's Unemployment Report. Consensus estimates were looking for job growth and that is very unlikely. In a report released by Challenger, Gray & Christmas yesterday, employers said that they plan to lay off workers in the near future. This is the first increase since July of 2009. Employment growth will be harder and harder to hit in the next month and fears of a double dip recession are surfacing.

Corporations have been able to hit their bottom line, but revenues have been slow to recover. Guidance from cyclical companies has been very soft for Q1 and these stocks were priced for a full-blown economic recovery. As I have been stating, I will not "buy into" this economic recovery until I see a rise in the demand for oil and increased shipping activity. Economic statistics can be manipulated, but these numbers don't lie.

The market has broken critical support at SPY 108. I mentioned yesterday that you should have your put purchases working. If you did that, you are making fantastic money this morning. If you waited, you left a lot of money on the table. Yesterday, I also mentioned that the price action in the next few days would be critical. If the market was not able to mount a sustained bounce, we were likely to head lower in the near future. Today we have our answer.

I do not believe the ECB will properly address the credit crisis in Europe this evening and we are likely to see a nasty decline heading into the weekend. Tomorrow's Unemployment Report will also disappoint.

Stay short!

Daily Bulletin Continues...