Strong News From Cyclical Stocks Helps The Market Tread Water!

Strong earnings continue to fuel this market. Almost 30% of the S&P 500 companies have reported earnings and 70% of them have beat top line estimates. Over 80% of the companies have exceeded profit estimates. Stocks were priced for great news, but the results have been even better than expected.

In October and January, stocks sold off after the earnings were announced. That temptation is still there and traders have attempted to "sell the news". However, the numbers have been so strong that buyers are scooping up shares before the decline can even get started.

This morning, Caterpillar and Whirlpool blew estimates away. Cyclical stocks are hot and they are breaking out to new 52-week highs. The market is trying to make a new relative high, but the price action is sluggish.

The economic releases this week will not have a major impact on the market. The FOMC meets this week and most analysts feel the rhetoric will remain the same. The Fed Chairman has already stated that this recovery is fragile and interest rates need to stay low as long as possible. That posture is market friendly.

It is possible that rates will start creeping higher even before the Fed takes action. The market will evaluate information and it will start pricing in a rate hike well before it happens. India, Australia and Singapore have raised rates. China wants to put the brakes on its runaway economy and it is likely to raise rates soon. Canada is expected to raise rates .25% this week. If rates rise because economic conditions are improving, that is a good sign. The market can rally under these conditions.

Interest rates can also rise on credit concerns. Even though Greece will be bailed out by the EU/IMF, their short-term rates jumped to 13%. Investors are still fearful of a default. In fact, interest-rate spreads are widening in Portugal. The spread between Germany’s interest rates and Portugal's interest rates widened .3% overnight on 5-year notes. The credit concerns are spreading.

This week, the US will hold major bond auctions and almost $120 billion in new debt will be issued. The maturities are relatively short-term and the demand should be strong. These auctions take place every other week and it is very important to watch the demand. If the market feels that interest rates will rise, the demand will fall off and the implied yield will go up. If this trend continues once it is established, the Fed will raise rates.

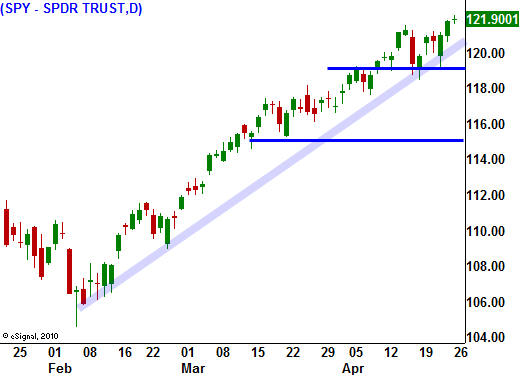

For now, great earnings will continue to push the market higher. I am not expecting a major rally, just a very slow grind higher. If sentiment gets overextended, look for a brief pullback towards the end of May. Any decline during the next few months should represent a buying opportunity.

The storm that is brewing needs time to gather strength. It will take a major event to topple this market. A credit crisis or deteriorating employment over a period of months is the most likely spoiler. Neither should be a factor until the end of summer.

Know that the easy money has been made and keep your size small. Do not chase this market. Wait for a small pullback in individual stocks and sell puts on support if they have reported great earnings.

Daily Bulletin Continues...