Now Portugal and Spain Have Joined The Party. It’s Not Just Greece Anymore!

For the last two months I have advised subscribers to trade the rally in a very passive manner. "Take a limited number of positions and keep your size small so that you can exit quickly". Today's price action demonstrates why this approach was emphasized.

The market kept grinding higher on better than expected news. Even though great results were priced into stocks, the results were better than expected. With over a third of the S&P 500 companies behind us, more than 70% of the firms have beaten top line growth projections and over 80% have exceeded net income estimates. The temptation was too "sell the news" and buyers snapped up shares when stocks pulled back on good news. The pattern of selling into earnings releases that we saw in October and January was not repeating itself.

This morning, Cummins, 3M and DuPont released fantastic earnings. The market was able to shrug off European credit concerns in the early going. By midmorning, conditions deteriorated rapidly and the market hit an "air pocket".

The two-year yield on Greek bonds has jumped to 15%. Investors in that country are running for the exits and the threat of a default is being priced in. I can't say that I truly understand this since the EU/IMF have already committed to providing $60 billion in aid. Now the credit concerns are shifting to Portugal and Spain. In both instances, credit spreads are widening.

I have been mentioning that PIIGS bond auctions will heat up in the next few months and over €200 billion in debt will be issued. Risk is being priced in and the demand for these auctions will be weak. This problem will feed on itself and credit concerns will spread to major nations like Spain, Italy and England. Eventually, our bonds will no longer be viewed as a "safe haven". Our debt levels are extreme and our spending is out of control.

This week, the Treasury will auction $120 billion in short-term bonds. This afternoon, we will see if the demand is high. I would expect it to be since investors are looking for "safety". The dollar is the reserve currency of the world and that should not change in the near future. It will take a major collapse in Europe for our credit worthiness to be questioned.

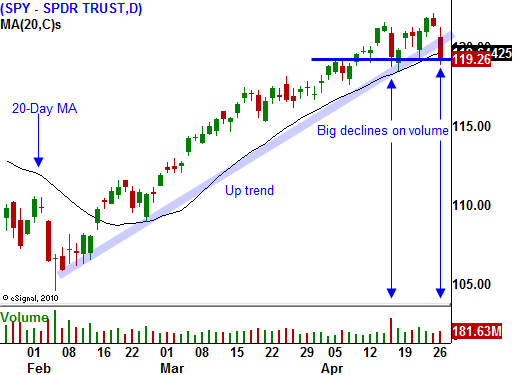

I still believe that the threat of a sharp pullback exists. Bullish speculators need to be flushed out. If the SPY drops to 115, that will have occurred. It is still too early for a major decline.

In 2007, there were many warning signs that a "housing bubble" existed. The market had a few sharp declines and then it would quickly rebound when there weren't any "dead bodies". Great earnings and strong balance sheets were the focus and traders refused to believe that a credit crisis was possible. We are likely to see the same pattern this time around.

The market will continue to focus on strong earnings, solid balance sheets and low interest rates. The rumblings of a European credit crisis will be ignored until three or four EU members are "on the ropes".

Corporations can see the storm clouds and they are acting prudently. They do not want to increase overhead expenses until they see sustainable growth. At present, they know that inventories are being replenished, but they don't know if demand has truly returned. Hence, they are not hiring.

Employment growth will stall in coming months for exactly this reason.

China presents fantastic growth opportunities, but their government is worried about a speculative real estate bubble. They have raised reserve requirements many times this year and they are close to raising interest rates. A few weeks ago, they put the brakes on residential real estate. Chinese citizens can only take out a loan for one home. On the commercial side, when current projects are completed, there will be 30 billion square feet of office space (enough for a 5 x 5 cubicle for every man, woman and child). If China's economy contracts, it will have a huge ripple effect.

You never know when the “big decline” is going to hit. The tendency is to have many small storms that result in a downward trend. Eventually, the news gets so dire that everyone decides to throw in the towel. That is when you can take a bearish position and stick with it (reference September 2008).

We are not to that stage yet. The market is selling off due to technical reasons. We are extremely overbought and the sentiment is too bullish. This decline will be sharp and the EU/IMF will calm nerves by helping Portugal. Spain’s credit spread is the one to watch. They currently have to pay about 1% more than Germany does to finance their debt (2-year bonds). If that rises to 3%, the warning signs will be there.

You can buy some puts today. Commodity stocks look weak and so do the financials. As always, use the Live Update table as your guide. I expect the market to decline into the close and there are not any big earnings to support the market overnight. If we drift down to SPY 115 and find support, take profits on your put positions. If we blow through that level, hang on to your puts and buy more. That is a major support level and there is more downside to go.

Daily Bulletin Continues...