Keep Scaling Into October Put Positions – The Window Will Close Next Week!

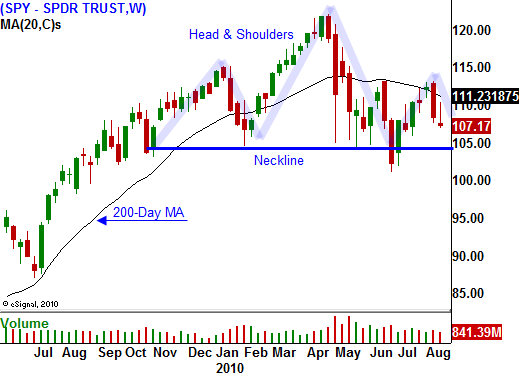

Yesterday, the market sold off on weak economic news. It closed below SPY 108 and is making a new five-week low this morning.

Initial jobless claims spiked to their highest level since November 2009. This marks the third consecutive week of rising initial jobless claims and it signals a weak employment number for August. The market shouldered this is fairly well before the open. Strength in Asia and Intel's takeover of McAfee created a strong bid for stocks. The straw that broke the camel's back came 30 minutes after the open. The Philly Fed was expected to rise 7.5 but it fell 7.7. That was an enormous miss and economic conditions are deteriorating rapidly.

The S&P 500 declined after the news and it flat-lined the rest of the day. This morning, we are seeing follow-through to yesterday's decline. Asian and European markets were weak overnight.

The negative influences are building just ahead of the weakest seasonal period for stocks. Next week, durable goods orders will be released and they have fallen two consecutive months. Q2 GDP will be released Friday and analysts expect it to fall from 2.4% to 1.4%. If initial jobless claims climb for a fourth consecutive week, the market will tank ahead of the Unemployment Report on September 3rd.

The market is drifting down to major support at SPY 105. If it breaks that level, buy more puts. You should already be building a short position in October. Option implied volatilities have been cheap, but they are on the rise. I have been expecting them to creep higher and that is why we have been buying puts the last two weeks.

When this decline takes hold, the drop could be fast and furious. Many negative influences are converging just before Labor Day. This could be one of the best moves this year. Be ready.

The market feels weak today and we might see it drift lower in two close. It is option expiration so anything can happen.

Monday and Tuesday will be slow and you should still have time to buy more October puts.

Daily Bulletin Continues...