Finish Buying October Puts This Week – Bearish Action Will Fire Up Next Week.

Last week, economic news weighed on the market. Initial jobless claims rose dramatically for the third straight week. New claims rose to their highest level since November 2009. The Philly Fed was expected to rise 7.5 and it fell by almost the same amount. This was an enormous miss and it shows rapidly deteriorating economic conditions.

Even the recent takeover news (Potash, McAfee and 3Par) has not been enough to buoy the market. Corporations are flush with cash and they are putting it to work. Stocks are attractively valued particularly with two-year yields below .5%. This condition is keeping a bid to the market and I believe that the upcoming decline will be relatively contained.

That said, there is plenty of money to be made on a 10% to 15% correction. The tail end of earnings season is upon us and retailers are giving weak guidance. Cisco changed its tune and it cited rapidly changing conditions. That is consistent with the surprising decline in the Philly Fed last week and rapidly deteriorating employment. Greek bond yields rose Friday and Euro credit concerns might reignite. We are approaching the weakest seasonal period for stocks and the selling pressure will increase a week from today.

China will release its PMI (Sept 30th) and I believe it will fall below 50. That would indicate economic contraction. The entire world is counting on China to pull us out of this recession. Two weeks ago, we saw a dramatic market decline when China reported that imports decreased. The PMI will strike a nerve as traders prepare for a busy week of domestic economic releases.

I don't believe we will see a big decline this week. Durable goods orders have fallen two straight months and a dismal number won’t catch anyone by surprise. This number is so volatile that traders tend to take it with a grain of salt. GDP is expected to fall from 2.4% to 1.4%. This news is already factored in, but we might see a small decline in the market because it will have a negative psychological effect. Another bad initial jobless claims number this week would almost guarantee a horrible employment report the day before Labor Day weekend.

This is the calm before the storm. Continue to buy in the money October puts this week. The action will be light this week and there's a good chance that implied volatilities might decline slightly.

Once the selling takes hold, it will be difficult to enter put positions.

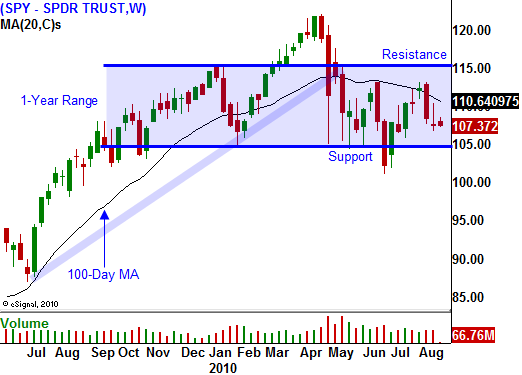

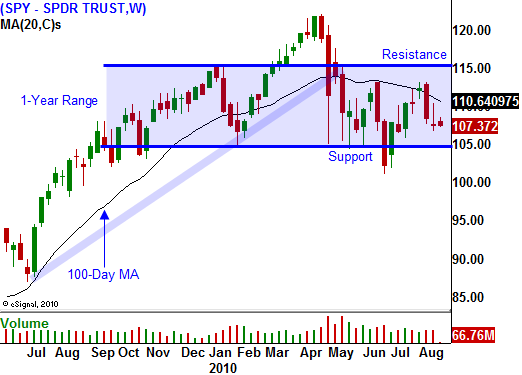

In today's chart you can see that the market has been in a fairly tight range for the last year. If we break below support at SPY 105, the selling pressure will accelerate.

Daily Bulletin Continues...