If You Thought This Was A Volatile Year – Get Ready For a Wild Ride In 2012 – Happy New Year!

The overnight news was very light, but the action will heat up next week. The market has had a 2 point range on the S&P during the first 30 minutes of trading and it looks like we are in for a quiet day.

The market is closed Monday and China/Europe will release their PMI's. HSBC released its PMI for China and it came in at 48.7. This is the second consecutive monthly decline in manufacturing. Some analysts believe that China will lower its bank reserve requirements this weekend.

Next week, ISM manufacturing, ISM services, ADP employment, initial claims and the Unemployment Report will be released. The market is expecting excellent job growth since initial claims have been declining this month.

The Iowa caucuses will be held next week and Republicans will start the selection process.

In two weeks, earnings season will kick off. Many companies have provided cautious guidance.

Credit ratings agencies will downgrade European sovereign debt in coming weeks. That dark cloud will keep a lid on stock prices.

The S&P 500 finished flat for the year and 10-year yields are below 2%. We have done well across all of our services, but this has been a tough year for investors.

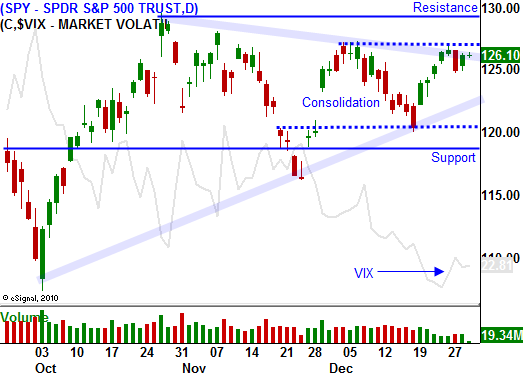

The volatility should increase next year. Bulls will rally behind attractive stock valuations, solid balance sheets, good earnings, low interest rates and low inflation. Bears will worry about a European financial crisis, a slowdown in China and political gridlock in the US. The tug-of-war will last the entire year and global credit conditions will deteriorate.

Our trading strategy next year will take advantage of this volatility.

Look for very quiet trading today with a downward bias. In the last seven years, the last trading day has been down six times.

May you and your family be blessed with health and happiness in 2012.

Happy New Year!

.

.

Daily Bulletin Continues...