Strong Jobs Report – But Too Many Bulls. Wait For the Shakeout – Then Ease Into Calls

Posted 9:45 ET - This morning we learned that 175K new jobs were created in February. That number was better than expected (150K) and the S&P futures are up eight points before the open. This was a bullish number.

Even during horrible weather conditions, employment remained stable. Many analysts believe that pent-up demand will be unleashed as temperatures rise.

Economic growth in Europe continues to recover and China is relatively stable. The EU has weighed on global markets for years and it could be a longer-term catalyst.

Earnings grew 7.5% and that is a robust pace. Corporations are buying back shares and using cash for M&A.

Almost every analyst was calling for a jobs rally. If the number came out weak, they would blame it on bad weather. If the number came in strong, it would be a sign that economic conditions are favorable. Sentiment was extremely bullish heading into the number and we could see a small shakeout on the open.

Without question, interest rates will start to rise. We are close to the Fed's target jobless rate and rumblings of tightening will begin.

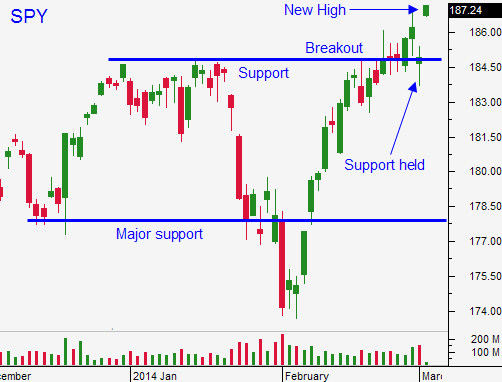

Now I have the confidence to buy this rally and I will get long this morning. Don't pile in; wait for the dust to settle in the first 30 min. If we do pullback, wait for support. Watch for a gradual grind higher and add on strength. Plan to enter positions over the next few days.

Asset Managers did not get a pullback. That means that they will be more aggressive. They don't want to miss the next leg higher.

Dips will be shallow and brief.

Buy horizontal breakouts. These patterns have momentum and the moves are sustained. A market tailwind will help to propel them. You will also have an easy game plan. Stop the trade out if stock closes below the breakout.

The news today was bullish from a longer-term perspective. This rally will continue into Q1 earnings.

.

.

Daily Bulletin Continues...