The Market Wants To Run. Bulls Believe That Spring Weather Will Unleash Pent Up Demand

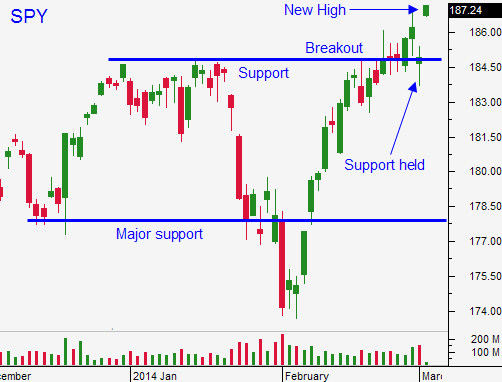

Posted 9:15 AM ET - This is been an interesting week. Turmoil in the Ukraine sparked selling Monday morning as Russian troops occupied Crimea. The market decline was brief and shallow. Traders saw this as a buying opportunity and stocks surged to a new high on Tuesday. The news has been rather "heavy", but the market does not care.

Russian troops were ordered back to their bases and negotiations are in progress. The US and Europe do not want to get involved and any action will be superficial. A peaceful resolution (occupation) is priced in, but this invasion is one stray bullet away from becoming a full-blown conflict.

Official PMI's came in mixed. Europe was slightly better than expected, but France and Italy are struggling. China's activity was light and in recent months it has been a concern. Today, Chinese investors were happy to learn that new real estate restrictions will not be imposed.

GDP, durable goods, and ISM services all came in worse than expected. Yesterday, ADP showed that private sector job growth was worse than expected (134K versus 155K expected). This report has typically outpaced the Unemployment Report and the news does not bode well for tomorrow's number.

Janet Yellen said that the Fed will continue its tapering program. A sustained economic decline would be needed for them to pause. This means that the safety net has been removed.

Traders are betting that this economic soft patch can completely be attributed to bad weather. Bulls are getting ahead of the curve. They believe that pent-up demand will be unleashed when spring weather arrives.

The bid is strong and the market wants to move higher.

I was shaken out of my long positions on Monday and I've been watching from the sidelines. This has been a good year and I don't want to force a trade. Chasing stocks at an all-time high ahead of a major news event seems foolish.

The price action this morning looks good and I will day trade from the long side today.

If the jobs report tomorrow misses by a wide margin, we could see a pullback. If the dip is brief, it would be a sign that Asset Managers are scrambling to get in. If the selling is sustained, there could be more to this soft patch than bad weather.

Although unlikely, it is possible that the number exceeds expectations. In that scenario, stocks will jump.

I am prepared to buy on weakness or strength. The macro backdrop is bullish and stocks have been able to shoulder bad news this week.

Wait for the jobs report and be ready to take action.

.

.

Daily Bulletin Continues...