Market Will Close Above SPY $189 This Week. Scale Into Call Positions

Posted 9:45 AM ET - Last week, the market broke out to a new all-time high. The expectations for a jobs report rally were high. If the number came in low, bad weather would be blamed. If the number came in "hot", the market would rally on better-than-expected employment. This seemed like a “can’t lose” proposition.

The number exceeded estimates, but the market was not able to hold early gains.

Bullish speculation was a little too high and we saw a light round of profit taking. That selling has spilled over and the S&P 500 is down four points before the open today. Traders will probe for support early this morning.

Over the weekend, China's economic reports were soft and Japan lowered its GDP projections. Asian markets are down as a result.

EU markets are moving higher. Their economic releases have been solid for a few months and a recovery is underway. Strength in Europe should offset slower growth in China.

Domestic economic releases have been decent considering the weather. The polar vortex has impacted consumption/activity. Fortunately, temperatures across the country will rise this week and spring is just around the corner.

Many economists feel that pent-up demand will propel economic activity. After what I witnessed this weekend, I’m inclined to agree.

I went to a mall Saturday and it was packed. There were very few parking spaces and I was amazed at the traffic. The lines were long at many stores and clerks said they were extremely busy. I'm not a shopper so I am not the best gauge of activity, but spending seemed robust.

Obamacare has been postponed for small businesses and it could be delayed even further. This is good news because it reduces uncertainty. Businesses might be willing to invest/hire.

The debt ceiling has been extended by a year. This also reduces uncertainty.

Earnings grew 7.5% and that is a healthy pace. Corporations are using cash for buybacks and M&A.

The Fed will continue its tapering program. The strong jobs report on Friday raises tightening fears, but that is more than a year away. Credit markets will adjust ahead of time and interest rates will creep higher as economic conditions improve. The initial reaction will be bearish, but the market will embrace higher yields as long as they are accompanied by economic growth.

Two steps forward, one step backwards. Get used to this price action.

The market made a new high last week and we can expect a small soft patch the next two days. Bullish speculators will get squeezed, but the damage will be contained.

Asset Managers did not get the pullback they were looking for. If they are under allocated, they will start to worry. They don't want to miss the next leg higher.

Dips will be brief and shallow. Let this wave of selling pass and start scaling into call positions when support is established. Take your time.

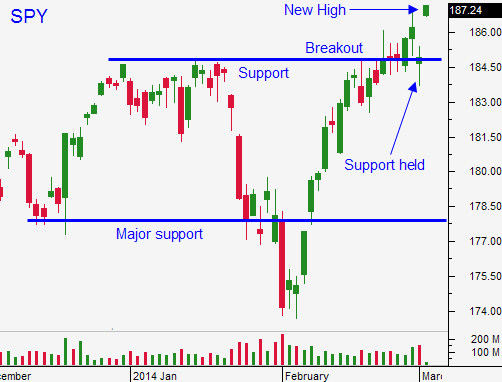

I believe the market will find support and it will rally above SPY $189 (Friday's high) this week. As long as major support at SPY $185 hold, stay bullish.

.

.

Daily Bulletin Continues...