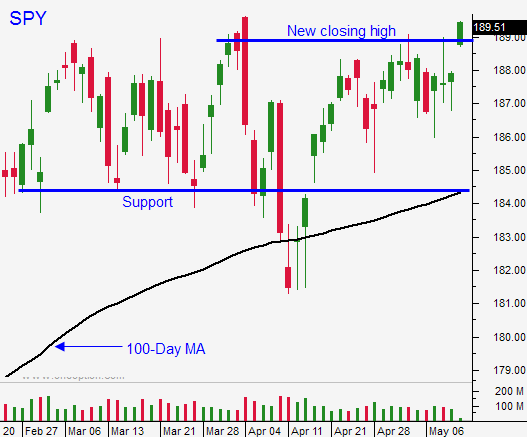

Market Breakout – New All-time High. Good Chance For A Short Squeeze This Week

Posted 9:30 AM ET (Market Open) - Yesterday, the market broke out to a new all-time high and it finished strong. Buyers have absorbed any profit-taking and we finally pushed through resistance. The open interest in out of the money calls that expire this week is high and we could see a short squeeze.

SPY call open interest at the $190 strike is 190,000. At the $192 strike price the open interest is 350,000. A 20-point S&P 500 rally would put those options in play and anyone who sold premium above the previous resistance level will have to reel them back in.

Quiet trading favors the bulls and next week we will be in pre-holiday mode. We could see a light volume melt up.

US stocks are benefiting from a lack of attractive investment alternatives. At a forward P/E of 16, stocks are not cheap. Profits are flat year-over-year and revenues have barely outpaced inflation. Asset Managers are closing their eyes, plugging their noses and hitting the buy button. They will not chase stocks at this level, but they will nibble. In quiet markets a small bid can push the market higher.

Europe's economy is struggling to rebound and China continues to slip. Money has rotated into bonds and yields are near historic lows (even Greek bond yields are at multi-year lows).

China's industrial production and retail sales came in a little light. These numbers will not weigh on the market. In the US, retail sales for April came in at -.1% (ex-autos and gas). Where is the pent-up demand?

The economic news is very light the rest of the week and earnings season is winding down. Retailers will start posting numbers and I'm expecting dismal results.

Elections in India are grabbing headlines. Their market has been rallying and the pro-business candidate appears to be winning.

The conflict in the Ukraine has not had much of an impact the last few months. NATO did not recognize the recent vote and Putin seems to be backing down.

I don't trust this rally and I'm not taking overnight positions. I will day trade from the long side and I believe the price action will be positive the rest of the week.

Aggressive traders can buy calls. Use SPY $189 as your stop.

The path of least resistance is up. This move is purely technical and macro conditions remain fragile.

Tread carefully and keep your size small.

.

.

Daily Bulletin Continues...