Quiet Trading and Holidays Favor the Bulls. We Need This Breakout To Hold

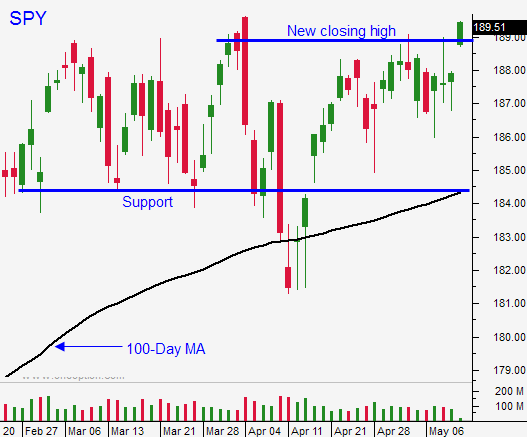

Posted 11:00 AM ET - This morning, the SPY is breaking out to a new all-time high. We've seen these moves before and they have typically resulted in a late day reversal. Let's hope this time is different.

The market has fallen into a tight trading range and if the breakout does not hold, we could be trapped for a few weeks. The economic news is light this week and earnings season is winding down. Memorial Day is right around the corner and activity will be dull next week as well.

If the market can hold on to these gains, trading volumes should pick up. Quiet markets and holidays tend to favor the bulls.

The vote in the Ukraine did not spark fear. The US/EU will not recognize the results.

Economic conditions in Europe are improving, but they are barely in positive territory. GDP is expected to grow 1.2% in 2014. The EU won't help or hinder global markets.

China's activity continues to slip, but as long as it is gradual, traders won't panic. Fiscal stimulus programs are keeping a bid to their market. They will release industrial production and retail sales Tuesday.

I thought we were seeing cracks in the dam when China posted dismal trade numbers two months ago. The trade numbers last week bounced back and for now the decline is gradual. The S&P 500 will not correct (15%) unless conditions deteriorate rapidly in China.

US economic conditions are stable. GDP came in at .1% for Q1 and analysts are expecting that to jump to 3% in Q2. Retail sales will be posted tomorrow and I don't believe we will see "pent-up demand".

The Fed will continue to taper and the bond purchase program will end in October. Tightening should begin a year from now and the market does not seem concerned.

Corporate profits are flat, but they remain at record levels. At a forward P/E of 16, stocks are fully valued.

The fact that the market has been able to tread water near an all-time high is bullish. Previously we've seen profit-taking at this level and buyers have been able to absorb that supply.

I am day trading, but I won't take any overnight positions. I need to see concrete evidence that demand is picking up. I do believe there is room for a correction, but I won't buy puts until I see a technical breakdown. My entry point is SPY $186, $184.50 and $183.

The rally today feels pretty good. The market has broken out and the buying is steady. Global markets performed well and that will provide a small tailwind.

I still consider this a very low probability trading environment. One bad news event could strip all of these gains away very quickly.

If you are compelled to get long, use SPY $189 as your stop.

.

.

Daily Bulletin Continues...