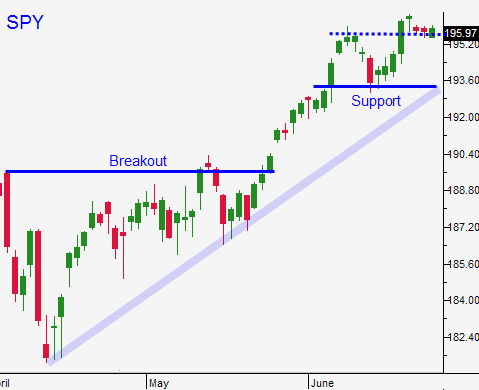

Nothing Can Shake This Market – Bad News Is Discounted – Use SPY $195.60

Posted 9:20 AM ET - This week it looked like we might finally get a small pullback. The conflicts in Iraq and the Ukraine are pushing oil prices higher. Inflation is rising and the Dow dropped more than 100 points on Tuesday.

The next morning we learned that Q1 GDP fell 2.9% and that durable goods orders missed expectations. The table was set for follow-through selling. After quiet open, stocks found a bid and they closed on the higher the day.

This market wants to move higher and it discounts any shred of bad news. The GDP miss was written off as "old news". In theory, pent-up demand from the polar vortex was going to fuel the recovery in Q2. Retailers continue to post dismal results and that does not look like it will pan out.

Job growth in the range of 200,000 does not keep pace with the labor force, but the market does not care. Next week ADP and the Unemployment Report will be released. The trading week will be shortened due to the Fourth of July holiday and we could see some decent price action.

The Fed lowered its projection for GDP growth in 2014 and they probably knew that the final reading for Q1 would come in weak. That is why they did not introduce new tightening measures last week. The FOMC also lowered its employment outlook and that might bode poorly for next week's jobs report.

Corporate profits were flat and revenue growth barely kept pace with inflation. At a forward P/E of 16, stocks are not cheap. The recent round of earnings (Adobe, FedEx and Micron) was good and earnings season kicks off on July 8th. Stocks typically perform well into earnings season.

Central banks continue to print money and as long as that safety net exists, investors have no fear. Option implied volatilities are at historic lows and risk is being discounted. It's hard to imagine that sovereign debt in a country with 25% unemployment (Spain) is trading on par with US Treasuries.

In my 25 years of experience, this is a correction friendly environment. I'm not calling for a top, but the market is very vulnerable. I believe the source of the decline will be credit related. It could be defaults in China's shadow banking industry or a small country (Argentina). I am on guard.

Stocks want to move higher and you can buy a few calls if the SPY closes above 195.60. Use that price as your stop.

I am day trading and I won't buy calls until I get a decent pullback.

We will get a heavy dose of news next week and then earnings season will be upon us. Trading volumes will increase and we should have some nice opportunities ahead.

.

.

Daily Bulletin Continues...