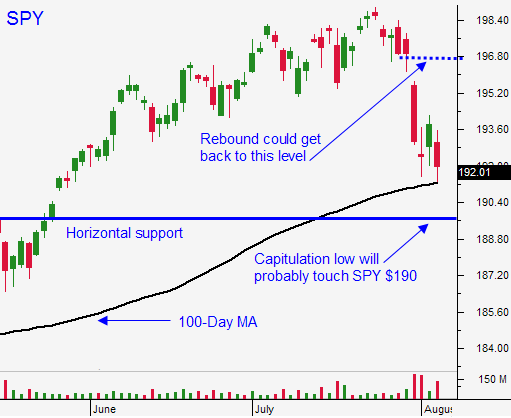

This Market Bonce Is the Real Deal. 100-Day MA Was Tested A Second Time and It Held

Posted 9:20 AM ET - Last week, the market breached the 100-day moving average and it tested that support a second time. Buyers stepped in and stocks rebounded sharply on Friday. We are getting follow-through this morning and the S&P 500 is up 10 points before the open.

Global conflicts have subsided over the weekend. Airstrikes in Iraq are working and ISIS has been repelled. President Obama said that air support will continue for months. Russian troops are no longer building on the Ukraine border. Rebel forces are losing battles and the Ukrainian Army is close to regaining control in the eastern half of the country.

Credit concerns in Portugal and Argentina are waning. As I mentioned last week, I did not believe that either situation would escalate.

Here are the positives.

Earnings season has been excellent and the guidance has been good.

Interest rates are not moving higher and the Fed said they would remain accommodative after tapering ends.

Economic conditions in the US and China are strong.

Bullish speculators have been flushed out.

Congress and the Fed are in recess and a light calendar favors the five-year bull market.

I believe the price action will be positive through Labor Day. The news is very light this week. China will post IP and retail sales on Wednesday. The results should be good. The EU will post preliminary GDP on Thursday. Given the recent soft patch, this news will provide a small headwind.

Last week I advised you to buy calls if the SPY traded above $192 and to add above $193. If you did that, you have an excellent entry point. Raise your stop to SPY $193.

The market should be able to get back to SPY $196 without much of a problem. It could struggle as it gets closer to the all-time high.

I still believe that this rally is in the ninth-inning and that seasonal weakness in September/October will weigh on the market. The Fed will end its bond purchase program in October and interest rates will start creeping higher into the FOMC meeting on September 16th.

Ride this bounce and move your stops up as the market rebounds.

.

.

.

.

.

.

.

.Daily Bulletin Continues...