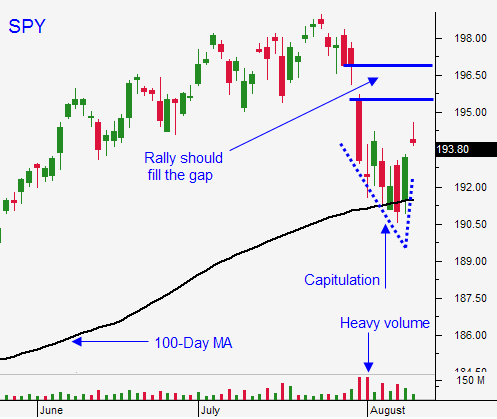

We Had A Capitulation Low and Follow Through Buying Monday – Move Stops Up – Protect Profits

Posted 9:20 AM ET - Last Friday the market tested the 100-day moving average for a second time. Buyers stepped in and we had a massive reversal. This is the pattern we were looking for and it represents a capitulation low. Yesterday, we had nice follow-through and the market is flat this morning.

In my comments last week I suggested buying calls when the SPY rallied above $192 and adding above $193. If you followed my advice, you have nice profits. Now let's protect those profits by moving our stop up as the market pushes higher.

The Ukraine is winning battles and it has regained control in many Eastern cities. Russia is sending a humanitarian convoy – we'll see how this plays out.

Washington DC is in recess and no news is good news.

Earnings season is winding down and the results have been excellent.

Interest rates remain low and the Fed plans to remain accommodative.

US retail sales for July will be reported tomorrow. Last month we saw slight improvement and the number should be market neutral.

China will post industrial production and retail sales tomorrow. Both numbers have been strong recently and the results should be market friendly.

The EU will post preliminary GDP on Thursday. They hit a soft patch and the news could weigh on the market. Many analysts are concerned that the economic sanctions against Russia will reduce growth in coming months.

A light news environment favors the five-year rally. Move your stops up to SPY $193.

I don't see any spoilers in August and the market should grind higher through Labor Day. The closer it gets to the all-time high, the stiffer the headwind. Time is also a factor. Interest rates will start to move higher as we get closer to the September FOMC meeting (16th).

Expect choppy trading in light volume with an upward bias.

We have a nice entry point, protect profits.

.

.

Daily Bulletin Continues...