Bullish Speculators Are Getting Flushed Out. This Is the Move We’ve Been Waiting For – Buy Puts

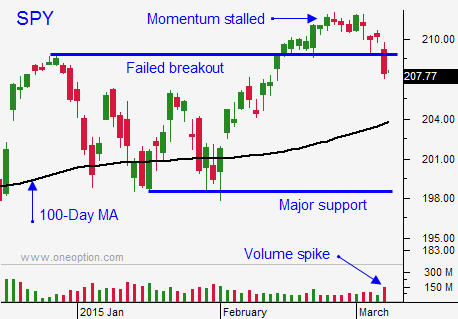

Posted 9:40 AM ET - Last Friday, a strong jobs report (+295K) sparked a round of selling as tightening fears escalated. Most analysts believe that the word "patient" will be removed from next week's FOMC statement (March 18). The SPY closed below support at $209 in the breakout has failed. The price action will have a bearish tone this week and we could test the 100-day moving average.

Most analysts feel that domestic economic conditions are far from robust and that the Fed has painted itself into a corner. They have leaned on the jobs report and now they will be forced to raise rates prematurely.

The Unemployment Report growth number is contrary to every other jobs report. Initial jobless claims have been rising, ADP came in light (212K) and Challenger expects 50,000 layoffs this month. The oil sector is weak and retail is lackluster. Cold weather will impact construction. I don't trust the government’s number and it will probably be revised lower next month.

All that matters is the information we have at hand. This was the second strong jobs report and traders are expecting higher interest rates. Many states have increased the minimum wage and that will start to show up in the next few months. This is inflationary and it will put pressure on the Fed.

Friday's decline took a while to unfold. Once the momentum was established, bullish speculators were flushed out. I've been expecting this move for the last couple of weeks because sentiment was too high.

Over the weekend, China's trade numbers came in much better than expected. They overpowered the weakness in January. Germany's trade numbers were little soft.

Greece submitted a proposal to the EU and rumor has it the EU response has been favorable. If by chance it doesn't get approved, Greece has threatened another round of elections. This dark cloud will hover over the market constantly.

The news is fairly light this week and that favors the bears. The breakout has failed and we will see profit-taking.

I am long puts from last week and those positions are in great shape. I also shorted the S&P on Friday (day trade). I did not get overly aggressive. I will be buying put options this morning after the initial rally stalls. The market will try to bounce, but it won't gain traction. Eventually, the downside will be tested.

Get short when this bounce stalls and scale into puts on weakness. Use SPY $209 as your stop on a closing basis.

.

.

Daily Bulletin Continues...