A Market Decline Would Provide Us With Clarity – If We Don’t Get One the Action Will Remain Dull

Posted 10:40 AM ET - This morning we learned that 295,000 jobs were created in February. That was much stronger than expected and tightening fears are elevated. The probability of a rate hike in June is below 50%, but it is climbing.

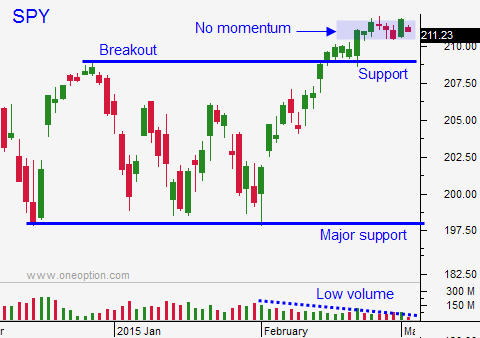

Stocks retreated on the news and the S&P 500 lost eight points. After one hour of trading, we haven't budged.

We need a drop today or we risk falling into a very tight trading range next week. The news is light and the market lacks a catalyst.

If this decline can gain traction this afternoon, it will flush bullish speculators out of the market. Then we will be able to gauge profit-taking and the strength of the bid. First support is at SPY $209.

If support holds steady and we bounce, the highs will be challenged. This will be a sign that buyers are aggressive. On the other hand, if support at SPY $209 fails, we are likely to challenge the 100-day moving average.

As much as I would like to trust the government's number, I don't. It is contrary to every other economic release. Initial jobless claims have been moving higher, ADP missed estimates and Challenger reported 50,000 planned layoffs. The oil industry is contracting and bad weather will crimp retail and housing. The government's number in January was not as robust as we first believed and it was lowered by more than 20,000. I believe we will see an adjustment to this number and bad weather in DC will be blamed.

For now, we have to trade off of the information in front of us. It is very likely that the word "patient" will be removed from the FOMC statement on March 18th.

The daily trading ranges are tight and the volume is low. I'm keeping my trading to a minimum in this low probability environment. I did buy some put options on energy stocks two days ago and my positions are profitable and small. I don't plan on doing anything until SPY $209 as tested. If the low from the first hour of trading is breached, I will trade the short side. I will use that as my stop and my target is SPY $209.

Let's hope that we get the decline.

.

.

Daily Bulletin Continues...