Sell Bullish Put Spreads – Take Advantage of Time Decay – Quiet Trading Ahead

I have an interesting call play today CLICK HERE TO TAKE THE FREE TRIAL. You will see us talking about it in the chat room and it is in Pete's List along with other stocks I am trading.

Posted 9:45 AM ET - Yesterday, the market probed for support early in the day and the S&P 500 was down 15 points. Buyers stepped in and most of the losses were erased by the end of the day.

China's retail sales and industrial production came in below estimates and economic conditions continue to slip. The PBOC eased by a quarter-point earlier this week and that will keep buyers engaged. Unfortunately, money printing is not stimulating economic growth.

We keep hearing about growth in Europe. Know that their GDP is a meager .4%. US GDP grew .2% in the first quarter.

Traders rejoiced at job growth of 223,000 last Friday. We need more than 300,000 new jobs just to keep up with the labor force.

The market is focused on a tiny quarter-point rate hike by the Fed when it should be focused on deteriorating global growth. At a forward P/E of 18, stocks are rich.

I don't believe we will see any big moves this week. The news is light and Memorial Day is approaching. Trading volumes will decline and we could fall into a tight trading range the rest of the month.

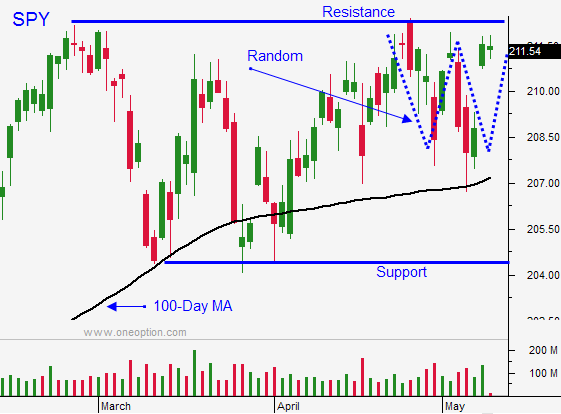

I have been selling out of the money put credit spreads on strong stocks. The decline yesterday morning was easy to weather. My bullish put spreads are out of the money and they are below technical support. If that support is breached, I will reel them back in.

I have a very interesting call trade that I'm in and I'll be adding to my position today if the stock moves higher. It has incredible potential - take the free trial and you will see it in the chat room and in Pete's List.

This is a low probability market environment and I'm keeping my size small.

Even though I am bearish, I don't see a major decline happening before Memorial Day. My put spreads are way out of the money and I will start to hedge if the SPY is below $209.

Distance yourself from the action and sell out of the money bullish put spreads. Look for quiet trading for the next 10 days.

.

.

Daily Bulletin Continues...