Quiet Market Ahead – Don’t Expect Big Moves – Sell Option Premium

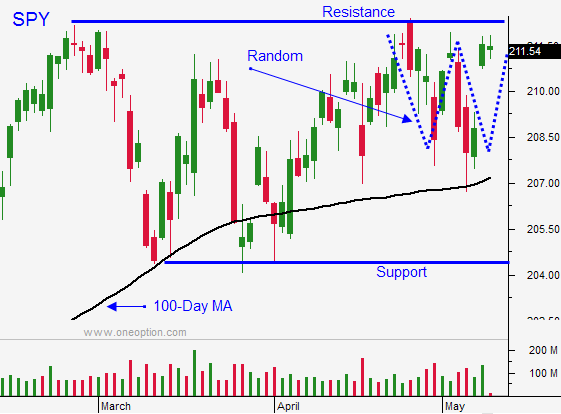

Posted 10:50 AM ET - Friday, the market rallied 25 S&P points on a mediocre jobs number. I told you the move had a short covering feel to it and that resistance was likely to hold.

The S&P 500 lost eight points yesterday and is down 14 points this morning. Most of Friday’s gains have been erased and the price action remains choppy.

China announced a quarter-point rate cut over the weekend and that news failed to spark buying. This is unusual since money printing as typically attracted buyers. Investors might be worried that the PBOC sees weakness ahead.

Earnings season is winding down, the FOMC does not meet for a month, major economic releases are behind us and a holiday lies ahead. Unfortunately, activity will decline and we are likely to trade in a narrow range.

Retailers will start reporting. I am expecting dismal results. Analysts will blame bad weather and they will dismiss the news on the notion that pent-up demand will surface this summer. I am not as optimistic. I believe consumers are very cautious.

Global economic growth is soft. Stocks are trading at a forward P/E of 18 and there is room for profit-taking. The market is trading at the top of the range and I believe the next move is down.

Greece needs to secure major loans in the next few weeks and that could spook investors. On a short-term basis, the Grexit would be bearish. Grexit would be bullish from a long-term perspective and we can get out from under this dark cloud. Credit risk is contained and this would send a message to other EU members.

I sold some put credit spreads yesterday and those stocks are holding up well. I can't get too excited about market declines until we close below SPY $207.

For the next week, I believe that we are in for quiet trading and I like selling put premium. I don't believe we'll see any big moves ahead of May option expiration.

If by chance we break the 100-day moving average, I will buy some puts. If we just chop around, my put spreads will generate income.

The market is back in the middle of the range and I expect it to trade between SPY $207 and SPY $211 for the next week.

.

.

Daily Bulletin Continues...