My Bias Is Slightly Bearish – Here Is Why I Am Selling Bullish Put Spreads

See what I'm trading. CLICK HERE TO TAKE THE FREE TRIAL. You will see trades it in the chat room and you will see the stocks I'm trading in Pete's List.

Posted 9:30 AM ET - Yesterday the market tried to rally and the momentum stalled early. The exact opposite happened Tuesday. Early moves reverse when they fail to gain traction and this choppy light volume price action will continue.

May options expiration will not fuel a move.

The FOMC minutes will be posted next Wednesday. I am not expecting much of a reaction since the statement was uneventful.

Flash PMI's will be posted Thursday. China's growth will be weak, but the PBOC has been easing. This will keep buyers engaged. Europe and the US will be sluggish, but I'm not expecting much of a reaction since central banks remain dovish. The Memorial Day holiday will suck the air right out of the market.

Unfortunately, the news after Memorial Day is also very light. We could see dull trading in a tight range the rest of the month.

Earnings season is winding down and I don't see any catalysts.

It is important to keep global economic growth in mind. China continues to slip, Europe is at .4% and the US is at .2%. Money printing is losing its luster and it is not stimulating activity.

Stocks are trading at a forward P/E of 18 and that is rich. Q1 revenue growth was at its worst level in years and profit takers will sell into strength.

With interest rates at historic lows, money continues to trickle into equities. Corporate buybacks are at record levels. Consequently, buyers will support the market when it dips.

These two forces will be in play the next few weeks and I'm not expecting any major moves.

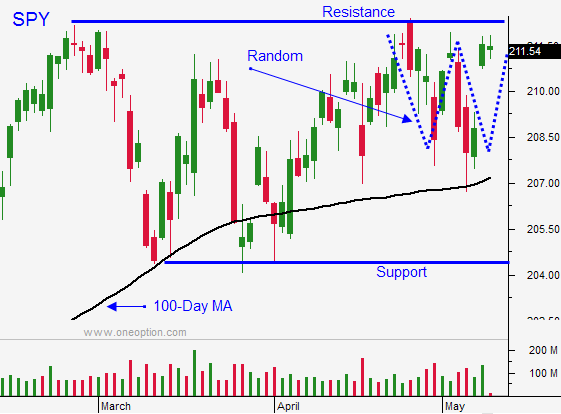

I am selling out of the money put credit spreads on strong stocks. My short strike is below technical support. If support is breached, I will buy back the put spread. My objective is to distance myself from the action and to take advantage of time decay. If the SPY trades below $209, I will start hedging on an intraday basis using the S&P futures. If the market trades below the 100-day moving average (unlikely in May), I will start adding short positions.

It might seem strange that my bias is bearish, but my strategy is neutral to slightly bullish. That is because we are in a 5 year up trend and holidays tend to have a bullish influence on the market. I am also looking for stocks that have dipped, but are still in an uptrend. Support has been established and I feel the downside is relatively contained.

The market has a tendency to ignore bad economic numbers and that will prevent sustained selling. I don’t believe the Fed will hike rates until September (at earliest) and Fed speak has the potential to spark a rally if this is confirmed. This is why bullish put spreads are the preferred strategy.

I am ready to hedge all my overall risk using the S&P on an intraday basis, but these threats have only lasted a day or two this year.

Look for quiet trading and sell some bullish put spreads to generate income.

.

.

Daily Bulletin Continues...