IBM Declines After A Beat – This Could Be A Warning Sign – Watch For Exhaustion

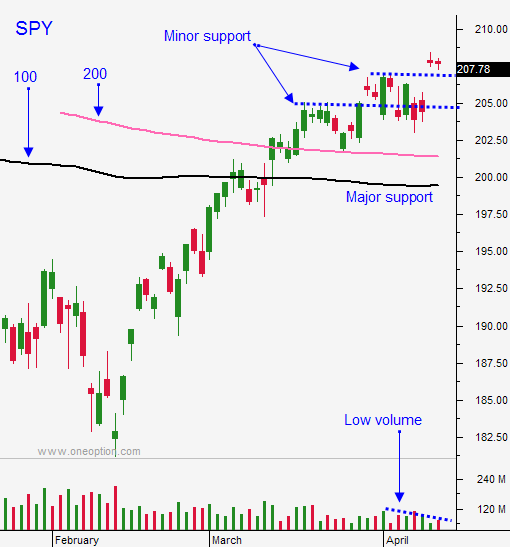

Posted 8:40 AM ET - Yesterday the market ignored the decline in oil. The S&P erased early losses and it shot higher. Stocks added to their gains from last week and we are seeing follow-through this morning. The S&P 500 is up eight points before the open and we are one good day away from the all-time high.

Many Asset Managers are in "risk off" mode and they have been reluctant to embrace this rally. Those who are under allocated are playing catch-up and they don't want to be short as earnings season begins. This has strengthened the bid.

The first wave of earnings reports sparks optimism and the strongest companies announce early in the cycle. I believe that we are seeing the final push higher.

Stocks are priced at a forward P/E of 17 and they are fully priced. After the close Monday, IBM beat expectations. Some of the profits were attributed to tax breaks and the quality of the “beat” is being questioned. IBM is down 4% and when stocks beat estimates and retreat, it is a warning sign.

Intel will post after the close today. PC sales are down 9.6% year-over-year. Intel has been expanding into mobile in recent years and those revenues will have to pick up the slack. Unfortunately, I believe the refresh cycle in mobile is starting to lengthen and we might see signs of that today.

Google will post after the close Thursday. It needs to spark excitement in the tech sector if this rally is going to continue.

Friday morning we will hear from Caterpillar, General Electric and Honeywell. Cyclical stocks have rallied dramatically in the last two months. Based on global economic growth, they look overvalued. These stocks are priced for perfection and I believe the guidance will be underwhelming.

I will wait for the results and I will watch the market reaction. When I see signs of exhaustion you'll be the first to know.

We sold puts in February and bought calls in March. Those swing trades ran their course and we have been cautious in the last 50 points of this S&P rally. Our day trades captured the move and we've had some nice shorts along the way as well.

The beauty in day trading is that you can catch rallies like this without taking any overnight risk. Day trading has been my bread and butter the last month.

I will be shorting this rally early in the day. I will look for relative weakness and I will short the stocks when the market probes for support this morning. I have been mentioning for weeks that I like fading big opening moves.

After the first hour of trading, I will use that range as my guide. If we are above it, I will focus on longs. If we are below it, I will focus on shorts.

The market should be able to grind higher for the next week and we are likely to challenge the all-time high. I believe the S&P 500 will peak shortly after Apple's earnings on April 25.

Focus on day trading and watch for signs of exhaustion. The market might still be a few weeks away from a sustained decline so don't prematurely short stocks. Let this final push run its course and wait for warning signs.

.

.

Daily Bulletin Continues...