We Needed This Rally – A Steady Grind Will Lead To A New High

Posted 9:30 AM ET - The market has been very sluggish and earnings season has not excited investors so far. We needed good results from mega cap tech stocks and we got it. The market is going to open higher this morning and we need to see follow-through.

Google, Microsoft, Intel and Amazon are all trading higher this morning. Tech stocks have not been participating in the rally and this could get them going. Next Tuesday and Wednesday earnings releases will climax.

The FOMC also meets next week and it will release its statement on Wednesday. That will be a fairly big event since the rhetoric has been hawkish.

Major economic releases (ISM services, ISM manufacturing, ADP and the Unemployment Report) will also impact the action. I'm expecting good numbers now that hurricane reconstruction is underway. Even if the numbers are a little "soft", the market will give the data a free pass for one more month.

The budget resolution passed by a narrow margin and that is also helping the market this morning. Politicians can shift the focus to tax cuts.

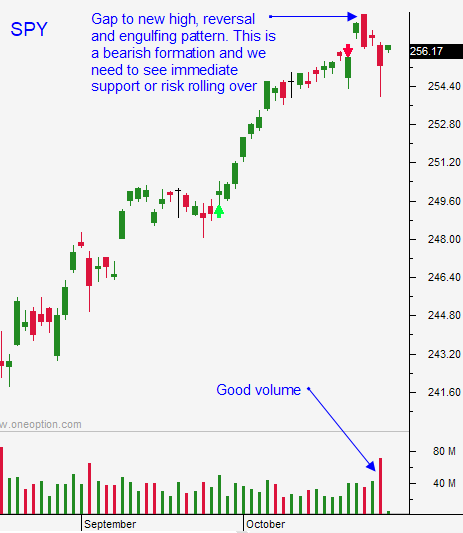

Swing traders should be long calls. We needed a solid reaction to the overnight earnings and we are getting it. This rally needs to grind higher and we need to take out the high. If that happens in the next week we can discount the reversal from Monday. Use SPY $255 as your stop on a closing basis.

Day traders need to be very patient. Every trade that I enter has to look good on a swing basis. The intraday momentum often stalls and I am comfortable holding the position overnight. I have been making most of my money swing trading and the last two months. If the market takes out the high I will get long and I will hold over the weekend.

Look for some nervous jitters early in the day and a steady grind higher. This type of price action will lead to breakout next week.

A reversal today is highly unlikely and it would be bearish.

.

.

Daily Bulletin Continues...