Massive Earnings News Today – A Muted Reaction Would Signal A Top

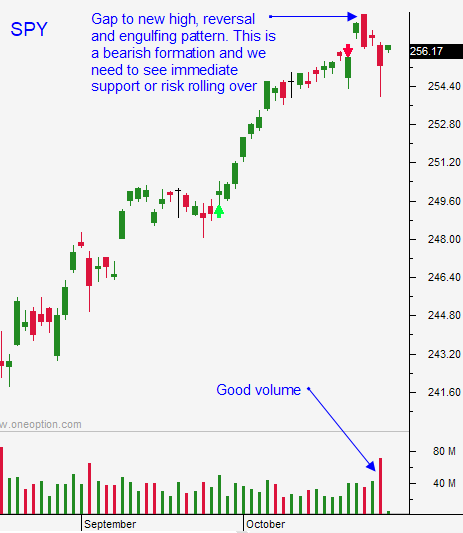

Posted 9:40 AM ET - Monday the market reversed off of an all-time high. That was a bearish pattern and we have seen profit-taking since then. Typically mega cap tech earnings attract buyers and this drop is unusual. We will know after the close if this selling was a warning sign.

Microsoft, Intel, Amazon, Bidu and Google will post results this evening. I believe this round of earnings will be good. These stocks are "fully priced" and it will take exceptional numbers to drive them higher. Earnings season is front end loaded and the strongest companies announce early in the cycle. If the market can't advance in the next week it will struggle to tread water the remainder of the year.

If earnings don't excite, the only remaining catalyst is a tax cut. The possibility of lower taxes will keep a bid to the market so we won't see any big declines. We won't see any big rallies either. The market is likely to flat-line and wait for the news. If tax cuts are passed we will see a rally on the news.

The FOMC will release its statement next Wednesday. Everyone is expecting a rate hike in December and the Fed hinted that there could be four rate hikes next year. This is more hawkish than expected.

Economic conditions are strong and they will improve as the hurricane destruction is repaired.

The take away from my comments is that earnings season is not fueling a rally to new highs. During the strongest time of the year this is a warning sign. We need to see a good reaction to the releases tonight and tomorrow. I was expecting two excellent weeks of upward momentum and we might not get that final push higher.

Swing traders should be long calls and they should use SPY $255 as a stop on a closing basis. Traders won’t short ahead of the big announcements this evening so I am expecting support in the tech sector today. I would view any tech selling today as bearish for the sector. That would tell me that the smart money is reducing risk ahead of the news.

Day traders should wait for early weakness. Buy the dip once support is established. Yesterday I bought S&P futures when my system gave a buy signal mid-day. This was an excellent trade and I am only day trading when the market pulls back. I want to trade from the long side and I want good entry points. Asset Managers are not chasing stocks, but they will buy dips.

The next week of earnings is critical. If the market can't rally we've seen the highs for the year. Be ready to take profits if the reaction is negative.

.

.

Daily Bulletin Continues...