This Market Rally Will Last Another Week – Then We Need Tax Cuts

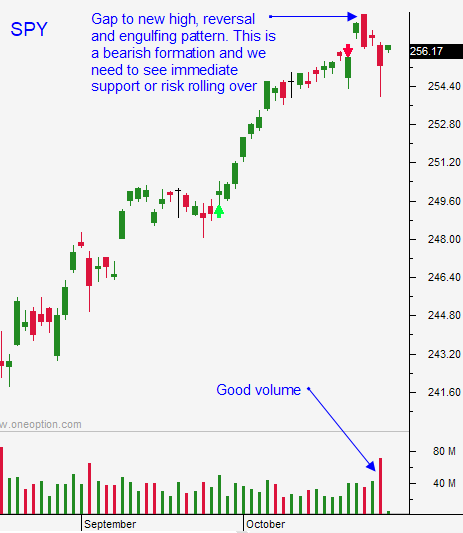

Posted 9:30 AM ET - Last week the market struggled to tread water during a heavy dose of earnings releases. Tech stocks were particularly weak and that changed Friday. Google, Microsoft, Intel and Amazon all rallied after posting good results. The market broke out and we can expect follow-through this week.

Stocks are opening on a soft note this morning, but that will quickly reverse. Buyers are engaged and Asset Managers don't want to miss a year-end rally.

This will be a busy week and earnings will climax Tuesday and Wednesday. Facebook announces after the close Tuesday and Apple announces after the close Wednesday. I am a little concerned with Apple and I am hearing that suppliers are cutting back production.

The FOMC will release its statement on Wednesday. The rhetoric has been fairly hawkish. We can expect another rate hike in December.

ISM manufacturing, ISM services, ADP and the Unemployment Report will be released this week. Analysts believe that 285,000 new jobs will be added in October. We should start seeing hurricane related job growth this month. If we don't, the number will get a free pass for another month. GDP came in at 3% and I'm expecting good numbers.

Swing traders should be long calls. This breakout should fuel a grind higher the rest of the week. After that, I become a little more neutral. Any material gains the rest of the year will only come if tax cuts are approved.

Day traders need to let the market come in this morning. Gains from Friday got a little overheated and the market will test the bid this morning. Once support is established, buy the dip. Bullish markets open on the low and they close on the high.

The FOMC statement and Apple earnings are the two potential speed bumps this week. Strong earnings from other sectors and good economic news will overpower them.

.

.

Daily Bulletin Continues...