Trump Crazy Like A Fox – Will He Push China Too Far and Spark A Credit Crisis?

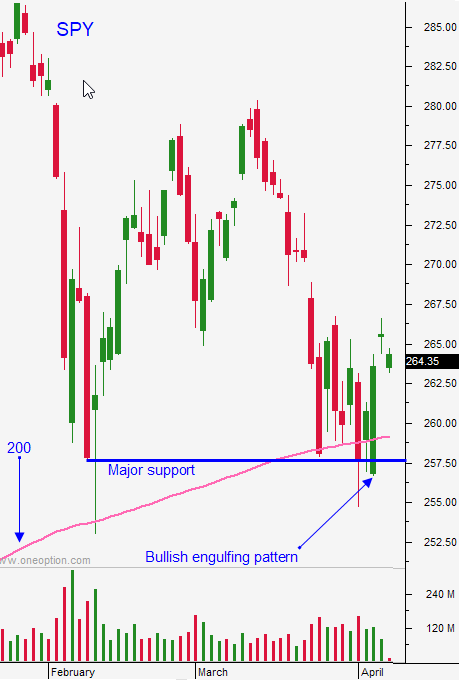

Posted 9:30 AM ET - Wednesday the market reversed sharply after testing major support. The move came early in the day and the S&P 500 closed 38 points higher. Yesterday we saw follow-through buying, but not to the extent that you would expect. Typically these capitulation lows have lots of fuel as shorts run for cover. This is a sign that the selling pressure is persistent. This morning the S&P 500 is down 27 points before the open on news that Trump is considering an additional $100 billion in Chinese tariffs.

Trump is either a smart as a fox or dumber than a box of rocks. A trade war could spark a credit crisis in China. They have enough commercial office space to provide every man woman and child with a 5 x 5 cubicle. China's shadow banking industry is enormous ($15 trillion) and there are cracks in the dam. Real estate trust products have $3.8 trillion in debt and a number of companies have recently delayed payments. There will be trouble with or without trade wars, but Trump might speed the timeline up. He knows that he is bargaining from a position of strength.

China is threatening to impose agricultural tariffs. This will instantly increase food costs and it will impact every Chinese citizen. They have been battling inflation for years and they finally have it under control. Commodity markets are very fluid. There isn't any intellectual property and prices are purely dictated by supply and demand. The US is a low cost producer.

Many believe that Trump doesn't realize that if China fails we all fail. This makes him particularly dangerous because he might follow-through with the tariffs and spark a global credit crisis. Unpredictability is his strength and he uses it to negotiate deals. Smart or crazy, we all have our opinions on Trump. No one has challenged China until now.

The market has taken the news pretty well. Traders don't think that Trump will actually follow through with the plan.

Global debt levels are unprecedented. Every central bank has to play nicely in the sandbox for this charade to continue. If any of the top five economic countries have a credit crisis the house of cards will start to crumble. Trump knows the leverage game and he is joining the spending spree (tax cuts, $1.3T infrastructure bill, $1T budget deficit…).

Credit is the key to the market and I watch yields very closely. It is the one thing that can spark a sustained market decline. The next crisis will be "the big one". When it happens there will be no safe haven. It could be months away or many years away.

This is a dangerous game of "chicken".

The economic data has been excellent, but it doesn't mean much right now. ISM manufacturing, ISM services and ADP were all strong. The jobs report was weak today (103K) and wage inflation (=.3%) was hot.

Earnings season will start in a week and profits always calm nerves. The results should be excellent.

Swing traders should be long financials. This sector has held up well and banks will start reporting next Friday (C, WFC and PNC). Use the 200-day moving average on the XLF as your stop on a closing basis. I am cautiously long. This trade dispute will hang over the market like a dark cloud.

Day traders should use the first hour range as a guide. If we are above the high favor the long side. If we are below the low, favor the downside. The high from yesterday is resistance and the low from the week is support. Between those two levels is the 200-day moving average. You can also use that as a guide.

The Unemployment Report was "light" and the wage component (+.3%) was "hot". This is a Friday and the rhetoric between the US and China is getting heated. This would be the perfect setting for a big decline. If by chance the market is able to shoulder this round of news it would be a sign that buyers are lining up.

.

.

Daily Bulletin Continues...