Buy This ETF On the Open – Great Relative Strength and Low Trade Exposure

Posted - 9:30 AM ET - Yesterday the market tanked on concerns that the trade war between the US and China was escalating. This was not completely accurate. The full list had not been published and when it became available investors panicked. The low from Monday was challenged on the open and stocks immediately reversed. Within two hours of trading we were in positive territory. This is exactly the pattern we have been looking for and I have referenced it a few times in the last week.

The fact that this move happened instantly was a good sign. Once the market was in positive territory we had plenty of time to add to gains. This morning the futures are up 13 points before the open and we will see follow-through buying.

Unfortunately, market conditions have changed and I am not nearly as excited about this bounce as I would've been a few months ago. The recent selling pressure has been heavier than I've seen in years. Valuations are little stretched and until the trade dispute is resolved we can expect volatile conditions.

In my comments yesterday I described the game of "chicken" that is being played by the two largest economies in the world. If you have not read it, you should. This could have far-reaching implications and credit markets concern me if a deal can't be reached in the next month. Both countries have said that any action will take months to implement so there is time to find middle ground.

For the next few weeks earnings season will be in focus. Nothing calms nerves like profits. Banks will start the cycle and the results should be excellent. Interest rates are moving higher and job growth has been strong. We won't get a huge lift from mega cap tech stocks since Facebook, Google and Amazon are under fire.

ISM manufacturing and ISM services were strong. ADP was very strong and Friday’s jobs report should be excellent. An hourly wage increase of .1% would be very bullish and that is what I expect to see.

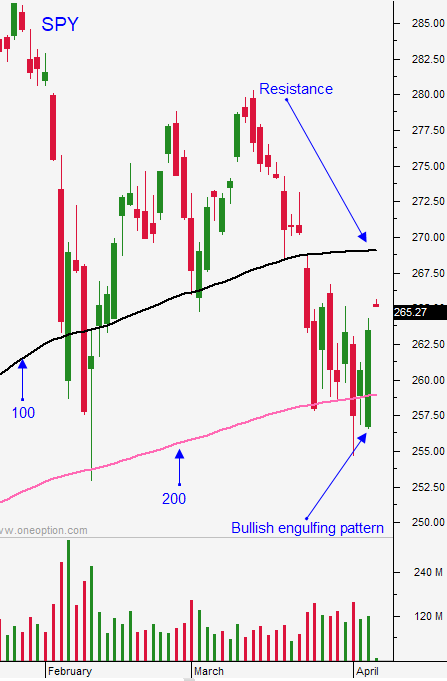

Swing traders should buy the XLF on the open today. This sector will not be impacted by trade wars and financials have been strong relative to the S&P 500. This will be a surrogate market position. Stop the trade out if the XLF closes below it 200-day moving average. XLF is sitting right above it and this is the first time this year that it has been tested. Market gains will be hard-fought and a possible trade war will keep a lid on the action. Without a trade deal I believe the SPY could get to $275 during earnings season. Once we get above the 100-day moving average I would be very careful. Market conditions have changed and my long-term bias has shifted from bullish to neutral for the first time in years. Swing traders should sell bullish put spreads and they should use the proceeds to buy bullish call spreads. Option implied volatilities are very high and you need to sell premium.

Day traders should wait for the market to test the bid today. Once support is established, trade from the long side. We will see some short covering and that will fuel the bounce. Take profits along the way and expect a choppy move higher.

I am cautiously long. As the market moves higher option implied volatilities will decline. This earnings bounce could set up an excellent put buying opportunity if trade negotiations stall. I will be looking for opportunities to buy calls and puts towards the end of the month.

We will see a nice move higher today.

.

.

Daily Bulletin Continues...