Market Rally Will Stall – Too Many Unresolved Issues

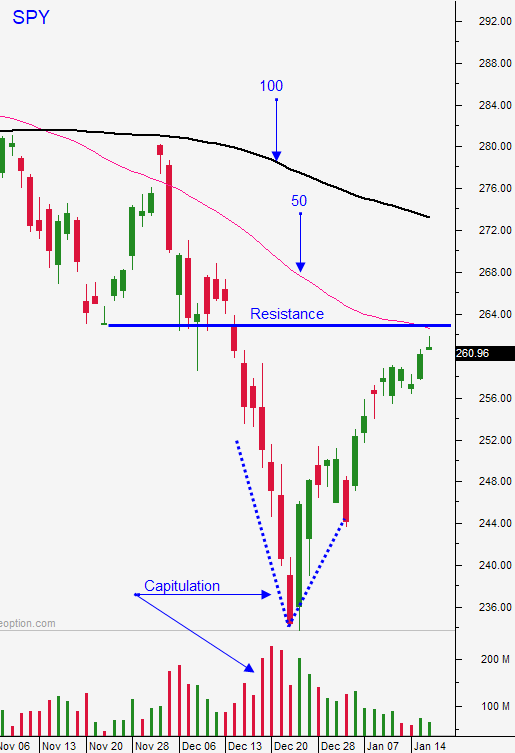

Posted 9:30 AM ET - The S&P 500 broke through the 50-day moving average on Friday and that support level needs to hold. There are many unresolved issues and the downside will be tested early this morning. We are in a bullish pattern of lower opens and higher closes. This is a long earnings cycle and we won't have clarity for another month.

China's economic numbers were in line. GDP fell to its lowest level since 1990, but it is still robust (6.4%). Industrial production and retail sales were slightly ahead of expectations.

Chinese/US trade negotiations seem to be progressing and talks will resume at the end of January. Both sides seem anxious to get a deal done. Ignore the rumors. This process will take many months.

Brexit is back to square one and Theresa May will outline "Plan B". She is trying to get more concessions from the EU. Opposition leaders are pushing to have the country vote on whether or not to leave the EU.

To a smaller degree, we have a similar standoff in the US. The government shutdown continues and Trump's proposal (funding for the wall in exchange for "Dreamer" amnesty) will be voted on today. Most analysts don’t think that it will get the 60 votes needed. The shutdown is having an economic impact.

There has been plenty of "Fed Speak" and the comments from Williams last Friday were dovish.

Banks are dominated the earnings seen and the reactions have generally been positive. Stocks are trading at a forward P/E of 15.5. Profits are expected to grow 11% year-over-year.

The IMF lowered its 2019 global growth forecast to 3.5% from 3.7% and that is weighing on the market this morning.

Swing traders should remain in cash. The 100-day moving average is at SPY $273 and the headwinds are blowing. There are many unresolved issues and the downside risks outweigh the upside rewards at this level. I am looking for an opportunity to short the market, but I need to see signs of exhaustion. When the market loses its momentum and it starts to compress I will be ready. That could happen at this level and the 50-day moving average would be my entry point when breached. With the extended earnings release schedule the market could try to grind up to the 100-day moving average. A compression at that level would be very attractive for put buying. Option implied volatilities would drop even farther. Big declines like we saw in December have aftershocks and this recent rally is only a bounce.

Day traders should look for opportunities to get long near the open. Wait for support to be established and buy. You have to make your money in the first two hours of trading. After that, the volume dries up and the range compresses. I am seeing two-sided action. That means that there are buyers and sellers. Once one side prevails, the market releases in that direction for an hour and then compress.

I will be focusing more on earnings releases this week. Those stocks tend to have decent volume and follow through during the day. The macro news is fairly light.

.

.

Daily Bulletin Continues...