Market Thru Resistance – Get Short If This Happens

Posted 9:30 AM ET - Yesterday the market instantly erased early losses and it rallied most of the day. We are seeing a bullish pattern of lower opens and higher closes. Late yesterday we learned that the White House wants to strike a deal with China and it might consider removing tariffs. Stocks rallied on the news and the S&P 500 tested the 50-day moving average. This morning it will open above it.

From my perspective, there is no news that we didn't already know. If China agrees to many terms (including intellectual property violations and imposing tariffs on US goods) of course we will drop our tariffs. We don't know China's willingness to negotiate. This process will drag on for many months and their economy will continue to contract. Trump feels that he has the upper hand and he will not give away his leverage (tariffs). Robert Lighthizer (US Trade Representative) pushed back on the news article and he is still taking a hard line.

Earnings season is kicking into high gear. The results have been good so far and analysts are expecting an 11% Y/Y increase in earnings this quarter. At a forward P/E of 15, stocks are still attractively valued. Guidance will be the key.

The government shutdown continues. The market does not care about it - yet. Q1 GDP will suffer as a result and the longer it continues the more it will impact growth.

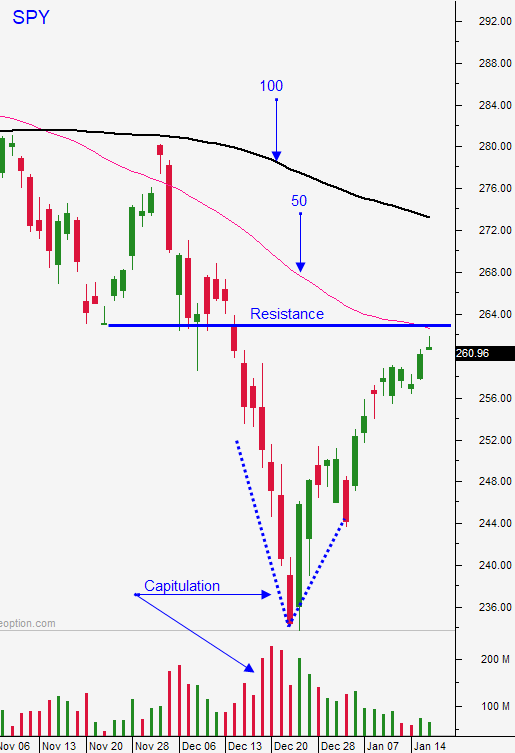

Swing traders should remain in cash. It is going to be tough to watch the market move higher from the sidelines, but we have to be patient. If the SPY trades below $262.80, go short. We will hold without a stop for the first day. That level is support and it will be our entry point if it is breached. If the market grinds higher we will raise our entry point. The issues that sparked the decline last fall are still unresolved.

Day traders should focus on the long side. Make sure the opening gap higher does not reverse. I don't believe we will rally until the downside is tested this morning. That could take 30 minutes or could take 90 minutes for that support to reveal itself. I like getting long around the $263 level because I can use a tight stop (50-day MA). Once the first hour range is established we are likely to stay in it. The volume has been very light and Monday is an exchange holiday.

This rally will run out of gas in the next week or two.

.

.

Daily Bulletin Continues...