How To Trade Earnings Releases -Use This Options Strategy Now

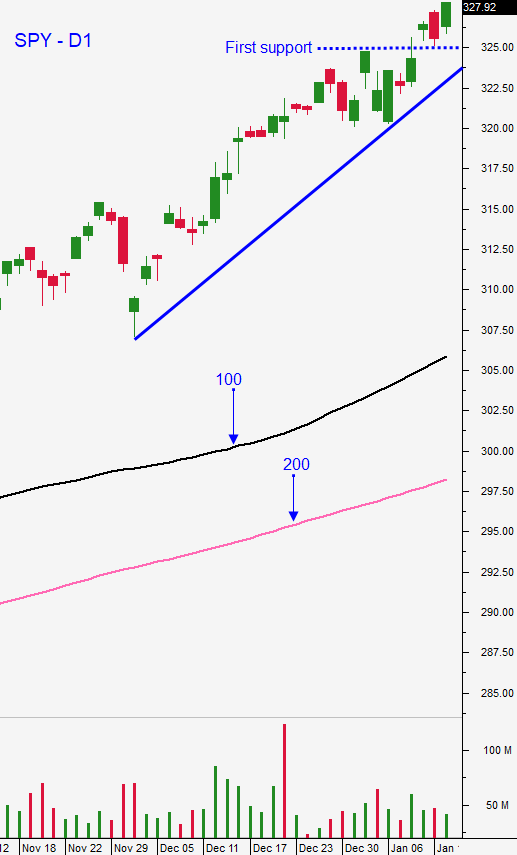

Posted 9:30 AM ET - PRE-OPEN MARKET COMMENTS THURSDAY - Yesterday the market rallied early in the day and it challenged the all-time high. After trying to poke through resistance a number of times the market retreated late in the day. We're starting to see signs of resistance and Asset Managers might be taking profits after a big run. The S&P 500 is up 10 points before the open and a light news cycle favors the upward momentum.

Not much has changed overnight. Trade deals with China, Mexico and Canada are attracting buyers and these agreements could add 1% to GDP this year.

Central bank money printing has pushed interest rates down to historic lows and that is providing a safety net for the market. Investors have to own equities to generate real returns because bond yields are not pace with inflation. Corporations are issuing cheap debt and they're using the proceeds to repurchase shares. Low interest rates are fueling this rally.

The economic data points have been good. This morning, retail sales increased .3% and that was slightly less than the .4% that was expected.

Earnings season has started, but the releases won't crank up for another week. It will provide many great trading opportunities.

Swing traders should have 25% of their capital allocated to bullish put spreads. We will start deploying the other 75% of our capital now and I just released great bullish put spreads in the swing trading video. Option Stalker has a search that identifies stocks that have rallied 75% of the time into earnings announcements during the last twelve quarters. This is a huge statistical advantage and we will be selling bullish put spreads on these stocks. Option Stalker also has a search that finds stocks that have reported earnings in the last 2 weeks and that have gapped higher on the news. The opening price from that gap needs to be maintained in order for the stock to appear on the list and this is also a gold mine or bullish put spreads. Finally, we will be looking for companies that posted fantastic results and that retreated on the news. We will wait for support and then we will sell out of the money bullish put spreads below that support. I am not expecting any market speed bumps that will spark heavy selling. I do expect to see 2-sided trading and I expect to see a small pullback to the SPY $320 level in the next few weeks. We will have to dance around that drop. It will be brief and shallow. A trading range will be established and we will stay in it during Q1 while stocks grow into their current valuations.

Day traders should wait to see if the early rally holds. Yesterday we saw the first signs of selling and I expect to see nice movement both ways. This market has been very difficult to short and I suggest waiting for dips. Get long on those moves and allocate less capital to shorting opportunities. Option Stalker searches like Heavy Buying, Relative Strength 30, Bull Run and PopBull have been flagging great trades.

Expect dull trading and an upward bias. I will be looking for option lottery trades this Friday.

.

.

Daily Bulletin Continues...