Option Lottery Trades – Conditions Are Right Today – Here Is What To Look For

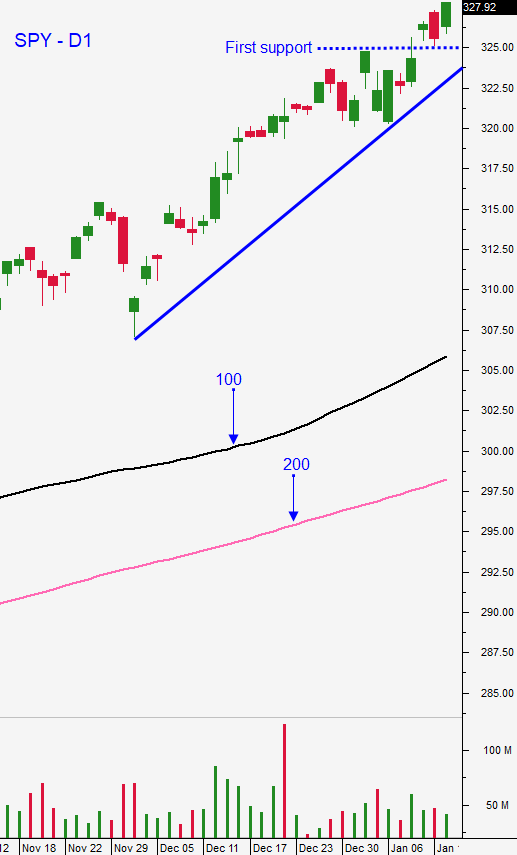

Posted 9:30 AM ET - Stocks surged late in the day Thursday to close at a new all-time high. Recently signed trade agreements with China, Canada and Mexico are fueling the move. The news cycle is light and that favors the current upward momentum.

The USMCA was signed yesterday and the Phase 1 deal with China was signed Wednesday. These are major developments and they could add as much as 1% to this year's GDP.

China's economic numbers were released overnight and they were strong. In 2019 their GDP grew 6.1% Some analysts will point out that it was the lowest growth rate in 3 decades, but any other country would do cartwheels for that level of growth. December’s industrial production was 6.9% (5.9% expected). Retail sales increased 8% and that was slightly better than expected.

Central banks are printing money and low interest rates are supporting this current market rally. Investors are piling into stocks to generate reasonable rates of return. Barring a credit crisis, this powerful force will keep buyers engaged for a very long time and market dips will be shallow and brief.

Stocks are a little rich at a forward P/E of 18 and earnings season will kick into high gear next week. It will take exceptional “beats” for many stocks to rally after the earnings release. I'm expecting a mixed bag of results with a slight downward bias in terms of price action after the number. This should provide a stiff headwind for the market.

Swing traders should be waiting for post earnings trades. Our option trading strategy is to sell bullish put spreads on strong companies that reported great earnings and that pull back on the news. We need to make sure that support is established before we enter these trades. As always, we will sell the bullish put spreads billow technical support. I am expecting a very stable market during the quarter and I believe we will establish a very tight trading range that could have a slight upward bias (trading channel). Option premiums are extremely low and we are forced to sell bullish put spreads close to the money. This means that we need to have upward momentum and strong support. Relative strength and heavy volume are key elements that will help us increase our odds of success. The easy money during this rally has been made and we will need to tread cautiously until we get a market pullback.

CLICK HERE TO TRY OUR RESEARCH FOR $29 AND GET IN ON TODAY'S OPTION LOTTERY TRADES

Day traders need to favor the long side. Buy dips on strong stacks and limit your shorts. Yesterday the price action was extremely tight for the first 6 hours of trading. We can expect similar price action in coming weeks. Small overnight gaps higher and compressed trading ranges will be the norm. I suggest holding some of your good performing day trades overnight to take advantage of these opening moves higher. Today is option expiration and I will be looking for option lottery trades. I will be looking for extremely strong stocks in the afternoon that have a chance to get through the strike price. I'll be looking to buy calls for pennies on the dollar if there is a market tailwind. If I have these elements, I will buy call options for pennies and trying to sell them 10 or 15 minutes later for a 100 or 200% gain. This options trading strategy can yield enormous profits with very limited downside risk. Unfortunately, trading options lottos is a low probability options trading strategy and patience and discipline are required. I typically like to do these trades in the last half hour of trading and I will hold them right into the closing bell. Since the action can get fairly intense late in the day, I typically place an order to sell half of the position at a double. This guarantees that I can't lose money on the trade and it makes it easier to manage the remaining options position. I will be highlighting a few of these option lotto trades in the chat room.

Look for an upward bias and compressed intraday ranges.

.

.

Daily Bulletin Continues...