How To Trade A Market Crash – Option Swing Trading Strategy With Picks [Video]

Posted 9:30 AM ET - The S&P 500 is officially in bear territory after falling more than 20% from its high a month ago. Coronavirus has wreaked economic havoc across the globe and consumers are changing their behavior to slow the spread of the virus. Social distancing is the most effective way to slow the spread and people should avoid large groups. Last night, President Trump addressed the nation and he imposed travel bans. The S&P 500 is down 120 points before the open and we will see another nasty day of selling.

I've been mentioning in my comments that things will get worse before they get better. The World Health Organization (WHO) labeled the Coronavirus a global pandemic. According to the attending physician of Congress and the US Supreme Court (Dr. Brian Monahan) 70 million to 150 million people in the US will become infected with the Coronavirus. We need to reach that saturation point before fear subsides. People need to realize that the threat is everywhere and that 3% of the population is NOT going to die from it. That is the statistic I keep hearing in the media and it is fueling the panic.

More than 80% of the population will fight Coronavirus off easily and people may not show any symptoms. The mortality rate is probably closer to 1%. China has the most deaths from the virus and they attribute a large percentage of that to the early cases where they didn't know how to diagnose the virus or how to treat it. Since then the mortality rate has steadily decreased. China has dismantled all of its temporary medical facilities because they no longer have the need for them. President Xi visited the epicenter (Wuhan) and China is getting back on his feet. To put this into perspective, only one in 400,000 people in China is died from the coronavirus.

Scientists believe that they have an effective treatment for the virus. It is a practice that has been used for many years. Patients who have recovered from the virus donate blood and the plasma has antibodies that will fight the virus. It is infused into sick patients. Biotech companies are scrambling to find a vaccine, but that could be months away.

The NBA canceled its season after one of its players tested positive for Covid-19. This is a preventive measure and the virus could spread quickly because of the physical contact in basketball. The NCAA will play the basketball games without fans. All of this news will impact consumer psyche.

From a health treatment standpoint, hospitals could be overrun if the outbreak escalates. If everyone practices social distancing the hospitals will be able to treat those who need it. People over the age of 70 and people with pre-existing health conditions are at greatest risk.

This change in consumer behavior will have a dramatic impact on the economy. Governments around the world are pulling out all of the stops to prevent a credit crisis. Central banks are lowering interest rates and flooding the markets with cash. We are likely to see cross-currency swaps so that countries support each other's currencies. Fiscal stimulus plans are also being enacted and President Trump is proposing tax breaks.

As the virus spreads in the next few weeks we will start to get some clarity. Corporations will report Q1 earnings and they should provide guidance. Once the dust settles there will be an excellent buying opportunity. Until then, cash is king.

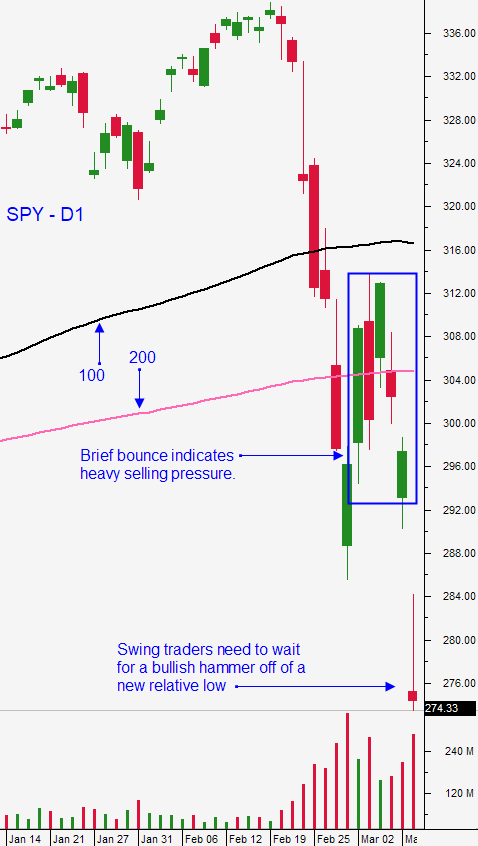

Swing traders need to remain in cash. Last night I posted my Weekly Swing Trading Video and I highlighted four bullish put spreads that I think will work. After posting the video I decided to cancel all of the trades. We don't need to stick our head in a noose. The Chicago Mercantile Exchange is going to close its trading floor after the close Friday. People will still have access to electronic markets, but open outcry will not be available. This will further reduce liquidity. In the video you can get a feel for how I would trade the current environment. The bottom line is that you have to be extremely selective in your stocks and you should only do the trade when your probability of success is so high that you can't resist the opportunity. As I mentioned, cash is king and you have to be the buyer of last resort during these free falls that are caused by panic selling. Track the spreads, see if they could have been filled and watch to see if they would've worked. All of this selling will take time to settle down. I believe that we are 2 to 3 weeks away from having some good opportunities.

.

.

CLICK HERE TO WATCH THE VIDEO - HOW TO SWING TRADE A MARKET CRASH

.

.

.

Day traders should forget about options. In last night's video you can see how illiquid options are across-the-board. Options that used to have penny wide markets are now trading with dollar wide markets. Stock is the way to go. We have been making great money day trading stocks with relative strength and relative weakness. We are using these stocks to trade market reversals. When the market is drifting lower we are looking for stocks with relative strength. As soon as the market finds support we are buying these stocks and they are leading the bounce. Once the bounce stalls, we exit. On that rally we are starting to look for stocks with relative weakness. Once the rally has ended and we have technical confirmation that a reversal is about to start, we short them. This trading tactic is nothing new to the chat room. We've been doing for years and there is a huge edge to trading relative strength/weakness. I suggest trading smaller size in this environment and to focus on a handful of stocks. The moves are large and by trading smaller size you can increase your staying power.

The SP Y 200-week moving average is at $265. It looks like that level will be breached on the open. The next major technical support level is SPY $235. This is panic selling and it's difficult to predict where we will find the bottom. The first sign will be a gut wrenching freefall that ends with a sharp bounce. The reversal will be filled with sequential long green candles closing on their high and the market rally will never look back. This will form a bullish hammer on the daily chart and the next day the market will gap higher and we will see a long green candle on the daily chart. Until we see that pattern, expect lower prices.

Stay healthy and limit your trading to intraday moves.

.

.

Daily Bulletin Continues...