Market Rally Still Has Some Legs But We Will Take Profits At This Level [Target Price]

Posted 9:30 AM ET - The S&P 500 has been able to hold the gains from last week during the last two sessions. This is a sign that buyers are engaged at this level and the S&P 500 is up 40 points before the open this morning. A “miss” from J.P. Morgan Chase and a dire economic warning from the IMF have not dampened spirits. The market is entirely focused on the containment of the Coronavirus.

J.P. Morgan added $6.8 billion to its loan loss provisions and that was the main reason earnings-per-share were only $0.78 ($1.84 expected). Yesterday, the company tightened home loan requirements. New homebuyers must put down 20% and they must have a credit rating greater than 700. Tightening consumer credit during a economic crisis will make the recovery even harder. We will hear from many banks in the next week and we need to watch the financial sector very closely. It is the key to any market rally and we want to make sure that credit concerns remain minimal.

The IMF expects global growth to decline by 3% in 2020. This is the lowest estimate since the Great Depression. Growth in Europe will drop by 7.5%. Spain and Italy will be the hardest hit and they could see economic declines greater than 9% this year. Both countries have been struggling with credit issues for the last decade and we need to watch this closely. A decline of 5.9% is expected in the US. China's decline will only be 1.2%. We can't trust any of the numbers coming out of China. They claim that their recovery is well underway and satellite images tell a completely different story. This Thursday they will post industrial production and retail sales.

As expected, the spread of the Coronavirus is decelerating in most countries. This is the primary market focus and an economic recovery can't begin until the virus is contained. The lockdown in the US needs to end on April 30th and companies need to restart operations immediately. The death toll will be much lower than expected and every week that the lockdown is extended will make an economic recovery exponentially more difficult. Credit is the primary concern. Central banks are printing money like mad to prevent a credit crisis.

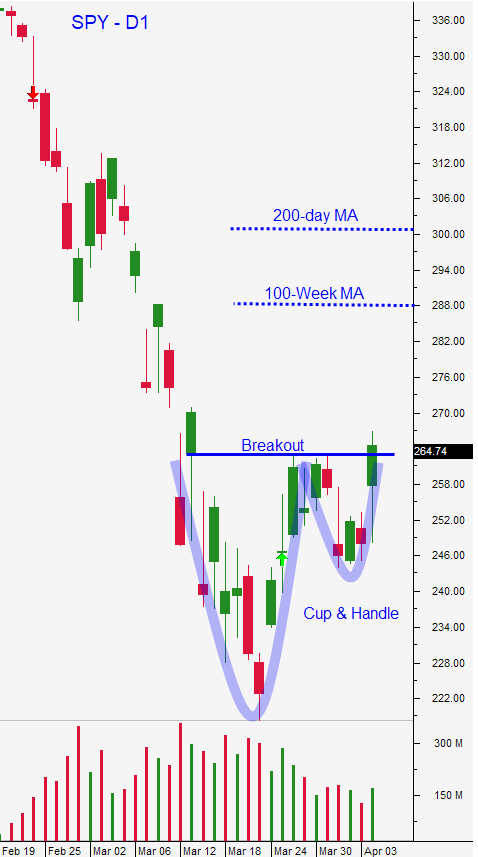

Swing traders need to place a target of $288 for our SPY position (long from $238). I believe that this leg of the rally still has some upside. There will be more selling in the next month and we want to try and reenter on weakness. This will be a bottoming process that will take many months. We are also selling out of the money naked put options on strong stocks that we want to buy at much lower levels. If we are not able to buy the stocks via assignment, we will generate a 10% return in a month. This strategy allows us to distance ourselves from the action and take advantage of time decay and extremely high option implied volatilities. The key to this strategy is picking stocks with relative strength and strong balance sheets. Option Stalker searches allow us to quickly zero in on these stocks.

Day traders should make sure that the early rally gains traction. I suspect that we will see a little selling early in the day and that will provide us with our window of opportunity. I still prefer to trade from the long side and I will patiently wait for a market dip. If the early rally holds, I will have to wait for a compression. During that pause I will look for stocks that are grinding higher without any help from the market. That would also be a sign of relative strength. Stocks with heavy volume will make the best candidates. I will take profits into strength and my goal will be to get back into a cash position so that I can objectively evaluate the market. Instead of babysitting positions, I will be looking for my next candidates. It's critical to wait for these windows of opportunity during the day. Typically we get a really nice opportunity early in the day and often we see one in the afternoon. I like to trade smaller size in the afternoon because the moves don't pack as much punch. The morning session is when I make my money and my goal is not to give any of it back.

Look for more upside in the next week as earnings season unfolds. Resistance is at $281, $288 and $300. Support is at$274 and $265.

.

.

Daily Bulletin Continues...