Take Gains On SPY Position – Price Action Is Changing My Bias

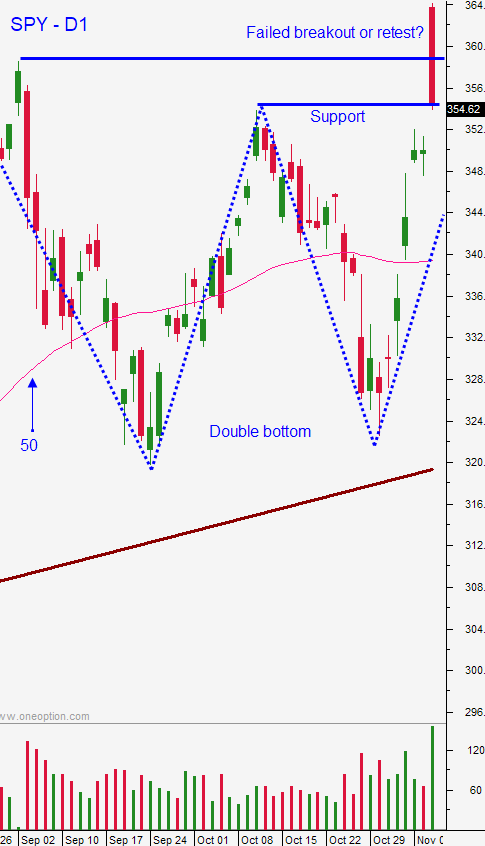

Posted 9:30 AM ET - The market has been struggling to regain its footing since the 150 point S&P 500 breakout Monday morning. That gap reversal Monday instantly tested the breakout and buyers have yet to return. Price action dictates all of my actions and we are going to take gains on our SPY position from Friday. I needed to see pent-up buying pressure and the last two days of trading have been very tenuous.

The Coronavirus vaccines are a huge positive for economic growth in the next few months, but we have to get through this rough patch. Eli Lilly just received FDA approval for its anti-body treatment. Moderna and AstraZeneca are close to completing Phase 3 trials and their vaccines are in mass production.

New virus cases are exploding and Biden's Covid advisor is suggesting a 4 to 6 week lockdown to control the pandemic. New York is imposing curfews and major metropolitan areas are in Phase 3 lockdown (many are considering more stringent actions).

Politicians need to take immediate action even if election results are not official. The stimulus bill is needed now and both parties need to compromise for the sake of small businesses and furloughed workers. Instead, the focus will be on which party controls the White House and the Senate. The budget deadline is also approaching very quickly and a government shutdown looms if they can't reach an agreement.

Ballot recounts, investigations and election run-offs will complicate the process and this is exactly what the market feared two weeks ago.

Economic growth has been stable, but it will deteriorate quickly as major metropolitan areas restrict activity. This morning initial jobless claims fell to 709,000 (a drop of more than 50,000 from the prior week).

Earnings season is winding down and profits were in line with lowered expectations. The current wave of the Coronavirus will also weigh on Q4 profits. Now that earnings have been released the new calculation for the P/E on the S&P 500 is approximately 40 according to the Wall Street Journal. Stocks are rich by historical standards. The rotation into cyclicals and out of tech did not last long. Yesterday we saw a rotation back into the "stay at home" tech plays.

Tech has another issue. Antitrust legislation is being considered domestically and internationally.

Swing traders should take profits on the SPY position we purchased last Friday on the open. Our entry price was $350 so we made a little money. I needed to see an instant rebound Tuesday and Wednesday and we did not get it. That tells me that the selling pressure is stiff. I tried to explain why this might be happening, but all that really matters to me is price action. We will always be able to buy if conditions change. I still like selling out of the money bullish put spreads on strong stocks. These spreads need to expire in three weeks or less and they need to be sold below major technical support. This dramatically increases our probability of success and we can take advantage of accelerated time premium decay. Staying very short-term on these trades also allows us to constantly evaluate market conditions. There are many potential speed bumps right now and we will error on the side of caution by taking profits on our SPY position.

Day traders should stay fluid. The market has had good intraday ranges and there are opportunities on both sides. I still prefer to trade from the long side, but that could change if the low from Tuesday fails. The S&P 500 looks like it will open below the low from yesterday. Wednesday was a banking holiday and the volume was relatively light. The S&P 500 had a fairly tight 20 point range and we are likely to break out above it or below it. Use that price movement as your guide. If we are above the high, favor the long side. If we are below the low, favor the short side. If we are in the middle of that range, reduce your size and trade count. As long as you focus on stocks with relative strength, heavy volume and breakouts you will be in good shape.

It's important to stay flexible under these conditions. Monday it seemed like the vaccine would finally get us out of this economic malaise. Today the focus is on an explosion of new Coronavirus cases, a shortage of hospital beds and new lockdowns. A few days ago the election results appeared to be concrete. Now, a Republican Senate and the Trump tax cuts might be in jeopardy. This is a critical juncture for DC and the country needs them to come together and sign a stimulus bill.

I'm not looking for a market meltdown, but a big breakout is less likely than it was a few days ago so we need to take some chips off of the table. Support and resistance are at the prior day's low and high.

.

.

Daily Bulletin Continues...