Purpose:

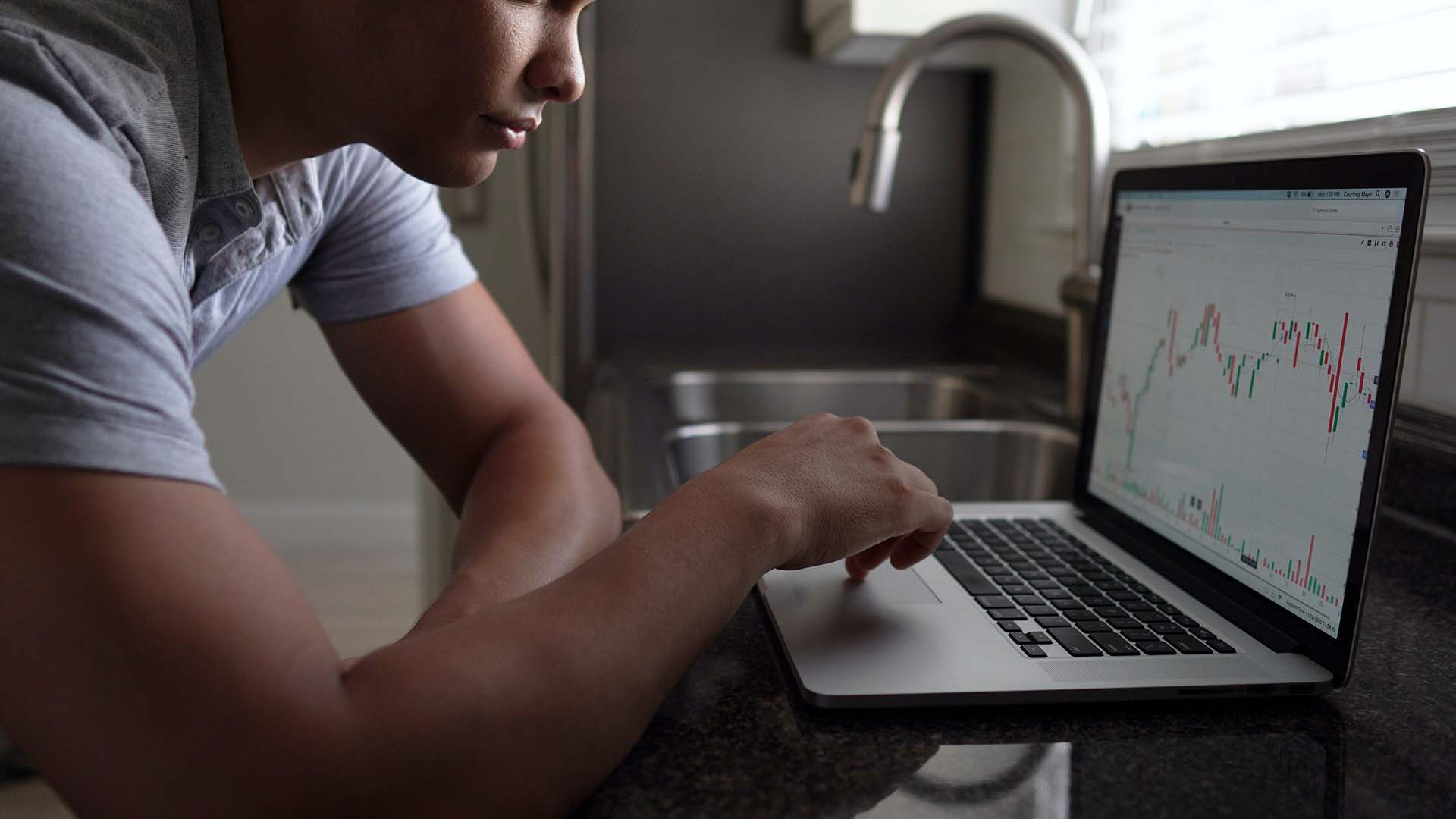

The Volume Weighted Average Price (VWAP) indicator is used to identify the average price of a security, weighted by volume, throughout the trading day. VWAP provides traders with insight into the market’s average price level, helping them assess whether a security is trading above or below its fair value during the trading session.

Key Components:

- Calculation of VWAP:

VWAP is calculated by summing the total dollar amount traded (price multiplied by volume) and dividing it by the total volume traded over the same period. This is done continuously throughout the trading day, giving an intraday average price that adjusts as new data comes in:- Weighted Price Volume Sum: This is the sum of the products of price and volume for each trading period. The price used is typically the average of the high, low, and close prices.

- Total Volume: The sum of the trading volume over the same periods.

- VWAP Data Series:

The VWAP is recalculated and updated for each new price and volume data point throughout the trading day. The final VWAP value at the end of the day provides a comprehensive view of the average price, weighted by volume, for that entire day. - Trading Applications:

Traders use VWAP to assess whether the current price is fair or overextended:- Above VWAP: Indicates that the security is trading above its average price, which may suggest a bullish trend.

- Below VWAP: Indicates that the security is trading below its average price, which may suggest a bearish trend.

VWAP is also commonly used as a benchmark for trade execution, ensuring that trades are executed near the average price level for the day.

Summary:

The Volume Weighted Average Price (VWAP) is a critical indicator for day traders and institutional investors alike. By providing a weighted average price that adjusts with each trade, VWAP helps traders⬤