Stock Option Trading Strategy – Bull put spreads and long call options on energy stocks.

Last week we saw a mixed bag of economic numbers. The ISM came in stronger than expected, unit labor costs dropped as productivity increased, hourly wages rose less than expected and the unemployment rate went up. The Fed sees a slowing economy and rising inflation. These two conditions offset each other from an interest rate respective. At this juncture a change in monetary policy can't be justified. I expect the rhetoric to remain unchanged when the FOMC comments are released Wednesday.

The market is taking its lead from earnings and M&A. Last Friday it shook off a weak Unemployment Report once rumors of a Microsoft/Yahoo merger were circulated. This morning there have been a couple of big deals announced and the market is trying to push higher. This week we will see the last big round of earnings announcements and here is a sampling of the companies that are about to release their results:

AMT, NILE, WYNN, FLR, MDR, MCK. MLM, MVL, HSIC, TYC, CSCO, ERTS, PCLN, ENER, LEAP, FWLT, LM, TM, ONXX, TXU, FLS, TK, WFMI, KG, LAMR, PDX, PDE, NVDA, AIG, GG.

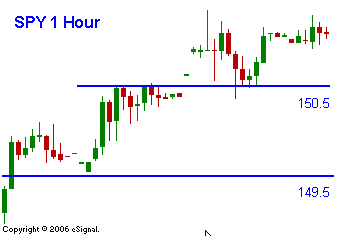

There are a number of stocks that I like in the above list; however, these companies don't pack the punch needed to have a major market impact. All things considered, the market needs to take a break and I believe that choppy trading lies ahead this week. Most of the earnings are out, we don’t have end-of-the-month or option expiration influences and the economic news is relatively quiet. Many traders will have their golf clubs packed in the trunk in case the activity slows down. This might sound like a joke, but it really happens. Traders would rather golf than force a bad trade in quiet markets. The SPY is bumping up against all-time highs and it will need a catalysts to get through. I have drawn a few minor support lines in today’s chart. Everything will calm down ahead of the FOMC. Once that passes, things are likely to settle down again. With expiration approaching I am adding bull put spreads for the month of June. I continue to hold my long call positions in energy stocks. I expect the market to establish an early range today.

Daily Bulletin Continues...