Stock Option Trading Strategy – Long calls on energy stocks and short bull put spreads.

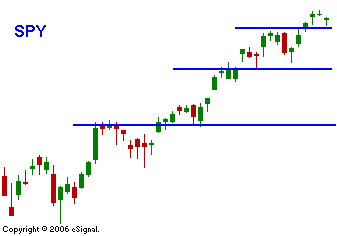

As expected the market is taking a little bit of a breather today. The overseas markets were lower over night and that is putting a little pressure on our stock market this morning. There is also some nervousness about the FOMC meeting. The Fed is a little more "hawkish" than most traders would like. I expect quiet trading ahead of the FOMC comments tomorrow. Every letter of every word will be scrutinized, the market will chop around and eventually it will settle back into quiet trading. My forecast is based on my belief that the rhetoric will remain unchanged. There are a number of earnings announcements this week, but none of them will pack enough punch to move the market in either direction. If the bears can't make a new intraday low after one o'clock Eastern Time, I expect an afternoon rally that will bring the market back to even. My option strategy is working and I will continue to sell bull put spreads. I am also long call options on energy stocks and I believe they will continue higher through mid summer.

Daily Bulletin Continues...