Stock Option Trading Strategy – Stay long commodities stocks and short consumer stocks.

There really is not much to report today. The market has a slightly positive bias in part due to bullish comments made by WDC, in part because it avoided a follow through decline from last Friday's dismal Unemployment Report and in part due to the observance of 9/11. It feels "un-American" to sell stocks on such a tragic day.

The analysts are having a field day arguing over what the Fed should do and over what they will do. Fortunately, that debate will end during next week's FOMC meeting. If the Fed lowers interest rates by a half point, I will view that as bearish. It means that they either waited too long or that they see deteriorating economic conditions. I will interpret a quarter point cut as an economic vote of confidence where they still feel global expansion will offset the housing weakness.

Next week we will see how the credit squeeze and housing slump have impacted earnings. Goldman Sachs and Bear Stearns will release earnings next Thursday. The financial stocks comprise 20% of the S&P 500 and they will be instrumental in determining the future market direction. We can also add option expiration to the mix.

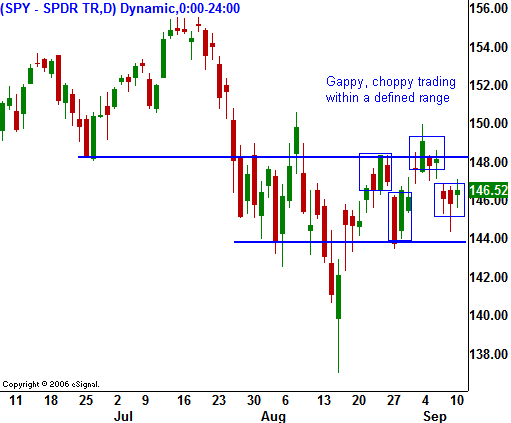

Given the events next week and the market’s "shoot first and ask questions later" mentality, I believe we will see a decline towards the end of the week. In today's chart you can see that choppy directionless price action.

Stay short consumer stocks and long commodities stocks.

Daily Bulletin Continues...