Stock Option Trading Strategy – Stay small, stay balanced. Long commodities/tech, short consumer.

As I mentioned yesterday, there is not much news to drive the market. Next week we have three monumental events that are likely to shape the market: the FOMC, earnings from GS and BSC, option expiration. Until then it's just not worth adding extraneous commentary in hopes of justifying the day-to-day noise.

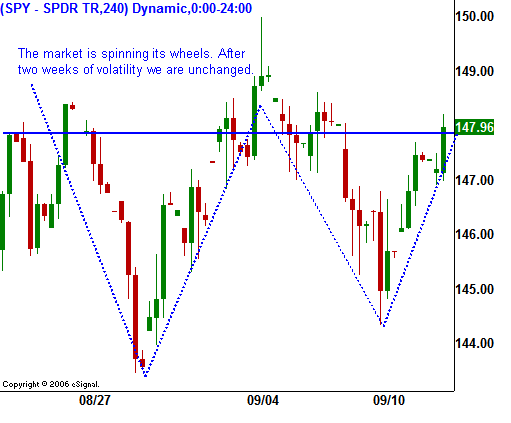

As you can see in the chart, we've been to hell and back in the last two weeks and we have nothing to show for it. This type of volatility is almost impossible to position trade. For those of you who are stock day traders, this environment is ideal. Once the momentum for the day has been determined, the market continues in that direction. The key is to make sure you go home flat because you never know what the next day will bring.

I am a bit surprised that the market is favoring the upside after last week's dismal Unemployment Report. I still suspect that the downside will be tested as we draw near to the FOMC meeting. The SPY 148.50 level represents resistance and I do not believe the market will be able to penetrate it today.

Keep your size small and balance longs and shorts. Next week we will see a breakout or a breakdown. That's when you need to be ready to take action. Stay long tech and commodities and stay short consumer stocks.

Daily Bulletin Continues...