Stock Option Trading Strategy – Buy calls on machinery, global construction, mining & energy stocks.

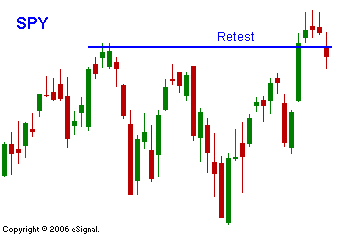

Yesterday the market was not able to forge its way higher. It started off strong on a positive reaction to the PPI number and decent earnings. By late afternoon the market had given up its gains. After the close, Intel and Yahoo announced earnings results. They were slightly below estimates and the market was expecting these mega-cap tech stocks to lead their sector higher. I have mentioned that I feel the tech rally is suspect because I haven’t seen a corresponding rise in guidance. Merrill Lynch posted very solid numbers and the market responded negatively. I did not understand that reaction since MER does not have subprime exposure. I feel that if the market is going to make a sustained rally it needs the help of the financial sector. Yesterday after the close we found out that the Bear Stearns subprime loan hedge funds were going belly up. The market had not expected a complete bust and it sold off after the close. The combination of negative events weighed on the overseas markets. This morning the S&P 500 futures are down 10 points. I do not believe that we will see a major meltdown today. The earnings were not bad. Yahoo has not gone anywhere in months and Intel is seeing profit taking after an overbought condition. As for the Bear Stearns debacle, where there’s smoke there’s fire. The extent of the losses was perhaps underestimated but I don’t think this comes as a complete surprise. We can expect to see further bad news come from housing and the subprime loan arena. I believe that option expiration and positive earnings will create a bounce today and the market will be able to get back above its breakout level. In the chart you can see that the SPY has dipped below it. If the bears can’t establish a new low after noon EST, look for the bulls to start nibbling. If they can establish support and grind the market higher, option traders will leg out of positions and goose the market higher. There is a bullish bias to option expiration. I still like the energy, mining, machinery and international construction stocks.

Daily Bulletin Continues...