Stock Option Trading Strategy – Buy calls on heavy equip, energy, global constuction and mining.

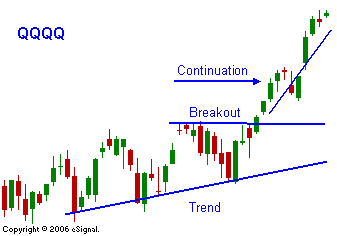

Yesterday the market opened higher and quickly settled in to a very tight trading range. After the big rally last week, I expected the market to take a break. There were key pieces of information that came out overnight and traders decided to wait and study. The earnings releases were positive for the most part. I liked the news from MER and STT and I believe the financial stocks will drive the market higher in coming months. For now, the solid earnings were met with a yawn. In the chart you can see that tech stocks have broken out and they are progressively adding to those gains. I have a couple of issues with that rally. The majority of the NASDAQ 100 breakout has come from 13 stocks. They have accounted for more than 60% of the move. The second issue I have is that the earnings guidance has not been raised by most tech companies. Nonetheless, I’ll respect the breakout. Tech stocks are still 50% below their high in the year 2000 and they have a lot of ground to make up as other indexes make new all-time highs. Today the PPI number generated a bullish reaction. The core rate was up .3%, .1% higher than expected. The market shrugged off the number as I thought it would and it is continuing to march higher. Earnings and option expiration will continue to drive this market higher. If the market has a day where it gradually grinds higher this week, option traders will embrace the move and they will leg out of positions, goosing it higher. I don’t believe the Fed Chairman’s testimony will shed new light Wednesday or Thursday. He is likely to stick to the script and the market won’t have any reason to react. The CPI is also likely to be a non-event. Today should be relatively quiet with a positive bias. If the market can make a new intraday high after 2:00 EST, there is a chance that it will grind higher right into the close. Buy calls in heavy machinery, global construction, energy and mining stocks.

Daily Bulletin Continues...