Stock Option Trading Strategy – Short call credit spreads on reatail and restaurant stocks.

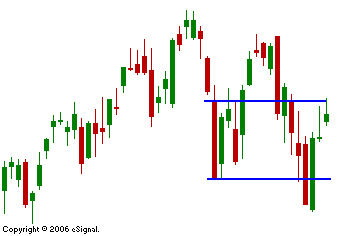

You can't fight the bid to this market. No matter how ugly things get, the buyers come in and destroy any negative price action before it can do any serious damage. Earlier this week the market looked like it was on the verge of breaking down. In one massive move, that picture changed. Yesterday the Fed changed a few words in its commentary. The market is still trying to decode the meaning. Just after the release the futures whipsawed back-and-forth until they finally closed unchanged. Today the market is heading back up but not in a convincing manner. If you look at the chart still seems like the big down day we had three weeks ago defined short-term support and resistance levels. The range is shown using the blue lines in the chart. When the lower level was breached, the market continued to drop. Once prices rallied back through that point, they continued higher. Today the market ran up to the upper blue line and then pulled back. I'm not going to read too much into this price action. Without question the volatility has increased and that usually precedes a big move. For the time being, the upward momentum has stalled and the easy money has been made. There is a firm support and resistance level. Things should quiet down next week. With the holiday falling right in the middle of the week trading will be light. There aren't any earnings releases worth mention and the economic releases for next week have failed to generate much of a reaction in the recent past. The big number will come next Friday with the release of the Unemployment Report. The market has been able to rally off of this number over the past few months. Employment has remained robust and wage inflation is moderate. As long as the SPY stays above 146 you should have a bullish bias. I continue to hold a few call credit spreads on restaurant and retail stocks. These groups have marginally rallied with the market in these positions are still in good shape. I'm not willing to get on this market rally bandwagon. I am waiting for the next move that can break out or breakdown with follow through.

Daily Bulletin Continues...