Friday’s Stock Option Trading Strategy!

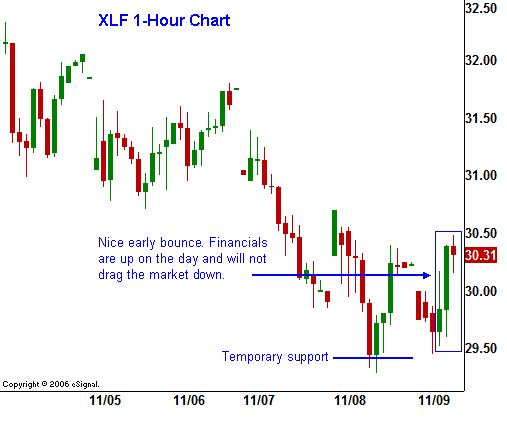

I am going to keep this brief. The market has been able to tread water during some very tough news from the financial sector. Early this morning, I noticed the financials bounced off of an early low. They are now in positive territory and I believe they will lead a reversal today.

The SPY broke below 149 and today it breached 146. Those are significant levels and I believe those events attracted new bears. Financial stocks have been pounded and I expect to see a short covering rally at very least. If that unfolds, it could create a giant short squeeze across the entire market.

I do not advocate getting long financial stocks. Commodity stocks and the tech leaders are the place to be. In the last two days, tech has been hit hard and I believe there are some good values there if you stay with strength.

If the market closes below SPY 146, get out of your longs. I am just looking for a very short-term trade today. If some upside momentum can build, there is a chance for follow through next week.

Daily Bulletin Continues...