Stock Option Trading Strategy: Bullish put spreads and bearish call spreads if SPY 141 or higher.

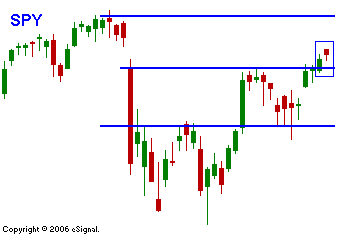

“Merger Monday” and beginning-of-the-month fund buying should lend early support to the market. We have seen a number of “soft” days in a row where the market has not been able to rally. The highs made after the FOMC are not being challenged and the market feels sluggish. The ISM was weaker than expected today. It showed that Cap Ex is down 4 out of the last 5 months and that prices paid rose from 59.0% to 65.5%. US manufacturing has been declining for decades, but it does demonstrate a current dilemma. The economy is showing signs of weakness and many feel the Fed should be in easing mode. However, inflation is on the rise and the Fed has voiced a “tight light” bias. There are analysts that feel the Fed won’t change their posture until they see a rise in unemployment. It is a lagging gauge of economic strength and by the time those signs appear, it might be too late. This sets the table for “Good Friday” and the release of the Unemployment Report. The market is closed in observance of the holiday and any hedges will have to be established Thursday. I believe there is a chance for a negative surprise. I recently read a report that claims 50% of the job growth from 2001 -2005 came from the housing boom. If that number is remotely accurate, the slowdown in housing might finally weigh heavy on the number. Construction and financing typically continue after the peak and it takes time for those lay-offs to cycle through. Today the first bank disclosed problems with its “Alt-A” loans and the second shoe might be ready to drop in the mortgage arena. The market has been in a 4-year uptrend and it still has strength. There were a number of intraday bounces last week and the bulls are not giving up. In the chart you can see how the SPY 141 level has come into play once again. If the bulls can’t rally the market, the bears will try to drive prices lower this afternoon. The A/D is a positive 3:2 so they will have their work cut out. A close below SPY 141 would be bearish. As far as my stock option trading strategy, I’m still neutral. At this level I’m ready to reel in my bullish put spreads and I will buy puts on a pullback. I am considering May put options for purchases because of the time premium decay during a holiday shortened week.

Daily Bulletin Continues...